Analysis: Chinese Chipmaker Rally Reflects Broader Industry Upswing

Some major mainland-based semiconductor manufacturers saw their Hong Kong stock double in value over the past two weeks, after Beijing announced a stimulus package

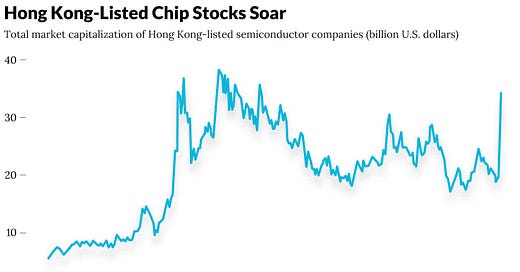

Chinese chipmakers popped following the announcement of a raft of new economic stimulus measures in late September, with the shares of some major mainland-based players almost doubling in value over the past two weeks.

The stocks, listed in Hong Kong, have since pared some of their gains, falling in tandem with the bourse’s tech and broader indexes. But the market capitalizations of chip manufacturers and related businesses remain elevated, which analysts say reflects a broader upswing in the semiconductor industry.

Semiconductor Manufacturing International Corp. (SMIC), the largest contract chipmaker based on the mainland, surged around 87% from Sept. 26 to close at a four-year high of HK$33.30 ($4.28) on Monday, valuing the firm at HK$265.5 billion.

On Sept. 26, China’s Politburo convened an economy-focused meeting, during which they emphasized the need for both monetary and fiscal easing to shore up capital market confidence, according to a readout of the meeting.

Hua Hong Semiconductor Ltd., another major contract chipmaker on the Chinese mainland, saw its share price jump 80% during the same period to end Monday trading at HK$32.55 apiece and with a market capitalization of HK$55.9 billion.

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.