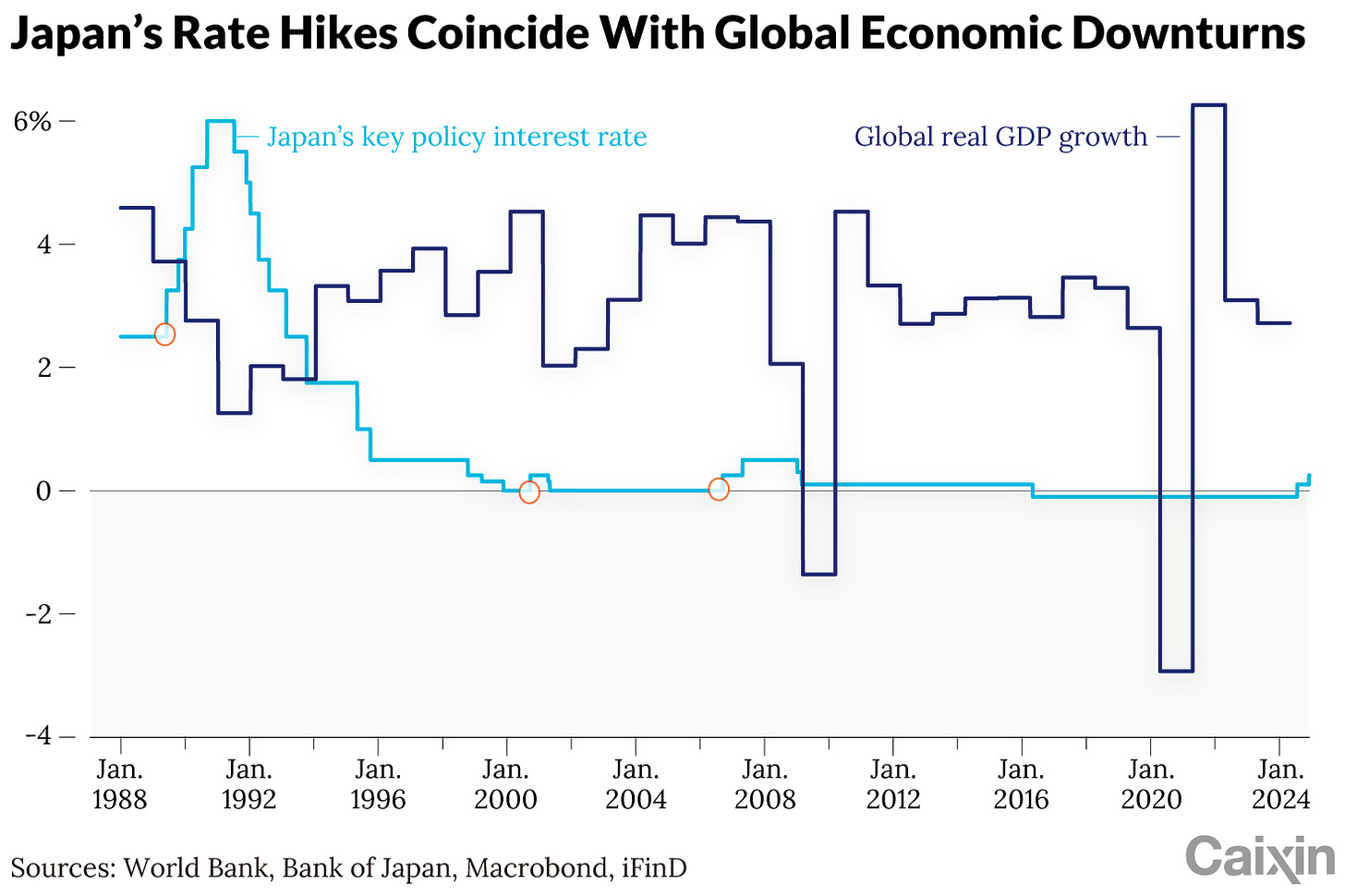

Analysis: Do Japanese Rate Hikes Foreshadow Global Downturns?

The Bank of Japan’s (BOJ) decision on July 31 to raise a key policy interest rate by 15 basis points to 0.25% sent the country’s stock market tumbling Monday, marking the largest single-day drop since 1987 and sparking a global market rout.

Although the Japanese market has since rebounded, and a deputy governor of the BOJ said Wednesday that the central bank will not raise rates further if the market is volatile, the events of the past week have fueled speculation of a global recession.

【Subscribe now to unlock more insights, just $0.69/week!】

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.