Analysis: Strong First Quarter Shows Promise of China’s Robotaxi Business

Industry leaders including Pony AI and WeRide report falling costs and higher sales, with an improved domestic policy environment and overseas expansion driving growth

China’s autonomous ride-hailing sector is gaining momentum, with top players including Pony AI Inc. and WeRide Inc. reporting strong first-quarter results that reflect rising demand and renewed policy support for the still-nascent industry.

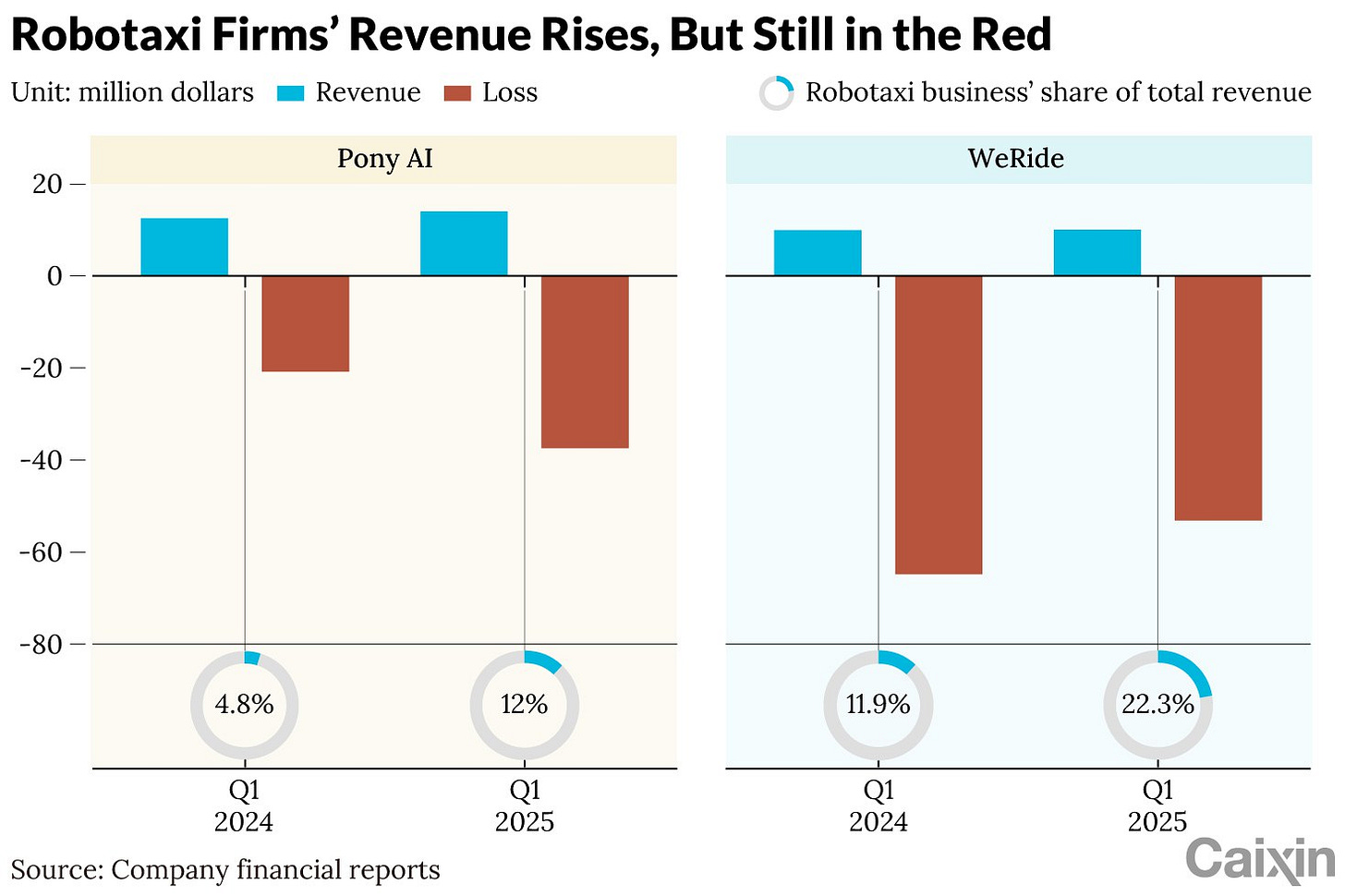

Nasdaq-listed Pony AI earned $1.7 million from its driverless cab service, or robotaxi, in the first three months of 2025, up 200% year-on-year, according to the company’s quarterly results released last week. The business, which includes passenger fares and technical solutions, saw fare-based income alone leap 800% year-on-year.

WeRide’s financial results showed its robotaxi revenue hit $2.2 million in the first quarter, contributing 22.3% of total revenue — up from 11.9% a year earlier. The company did not disclose revenue growth from the business but revealed its product revenue rose nearly 50% year-on-year, “primarily attributable to an increase in the sales of robotaxis and robosweepers in the first quarter of 2025.”

Search giant Baidu Inc., through its robotaxi service Apollo Go, is another dominant force in the Chinese mainland market, alongside Pony AI and WeRide. Baidu did not reveal Apollo Go’s revenue, but said it completed more than 1.4 million trips in the first quarter, a 75% year-on-year increase.

The figures offer a more upbeat picture for an industry that is still struggling to take off due to heavy reliance on policy support, profitability challenges, and a backlash from the traditional taxi industry.

The industry experienced a period of “policy cooling” after Baidu’s Apollo Go service faced fierce opposition from local cab drivers in Wuhan, the capital of central Hubei province, in the summer of 2024. A regional business development manager at an autonomous driving company previously blamed this on Baidu’s low pricing strategy to boost its autonomous service, a move considered malicious competition by local taxi drivers. The controversy led governments at all levels to take a more cautious approach to autonomous driving, sources close to regulators told Caixin.

But the policy environment warmed up again at the end of 2024,

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.