Analysis: Why China’s Two Manufacturing PMIs Are Diverging

The decline in the official PMI can be partly attributed to the weighting of large and midsize enterprises that have suffered more than small companies from the deteriorating business climate

(Editor’s note: The National Bureau of Statistics’ China manufacturing PMI is compiled from responses to questionnaires sent to purchasing managers at 3,200 companies in 31 key manufacturing sectors. The survey has greater representation of larger companies and state-owned enterprises.

The Caixin China manufacturing PMI is compiled from responses to questionnaires sent to purchasing managers at around 650 private and state-owned manufacturers across diverse sectors, spanning food products to basic metals and electrical equipment, and has greater representation from smaller, privately owned companies.

For both PMIs, a reading above 50 indicates an expansion in activity, while a reading below 50 indicates a contraction.)

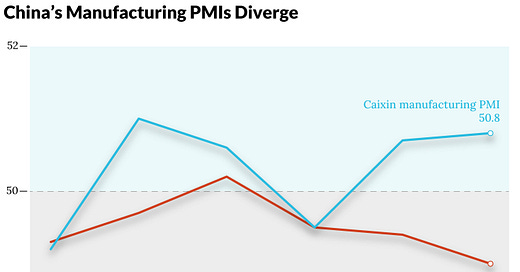

In the second half of 2023, a noticeable divergence emerged between the Caixin China manufacturing PMI and the official manufacturing PMI released by the National Bureau of Statistics (NBS).

From July to December, the Caixin PMI showed an expansion in activity for four months and a contraction for two months, with an average reading of 50.3. In contrast, the NBS PMI readings showed an expansion in only one month and a contraction in five months, with an average reading of 49.5.

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.