Analysis: Will China’s Relaxed Share Buyback Rules Help or Hinder the Market?

The amended regulation is meant to encourage the practice, which in theory is positive for stock prices, but skeptics warn the changes may amplify risks, deter investment, and enable more self-serving

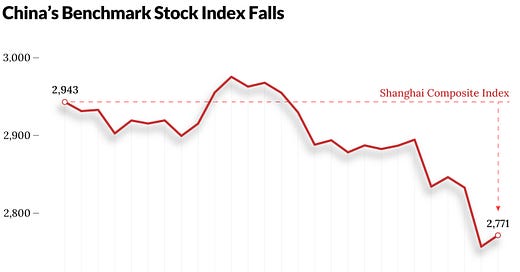

China’s new rules on listed companies’ share buybacks were introduced supposedly to shore up the sagging stock market. But skeptical voices are growing, warning the changes might in fact amplify market risks, deter additional investment, and enable more self-serving share repurchases.

Stock buybacks in theory give prices a quick boost by removing some shares from circulation and injecting capital into the market. However, the vast majority of repurchase proposals released last year were designed for equity incentives or employee stock ownership plans, which would redirect funds designated for universal cash dividends to instead benefit company executives and employees.

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.