Chinese Nickel Miners in Indonesia Face Threat from Falling Prices (Part 2)

As Indonesia has ferronickel overcapacity, the country is considering a ban on new pyrometallurgical nickel projects next year, Meidy of the miners association told Caixin

Switch in process method

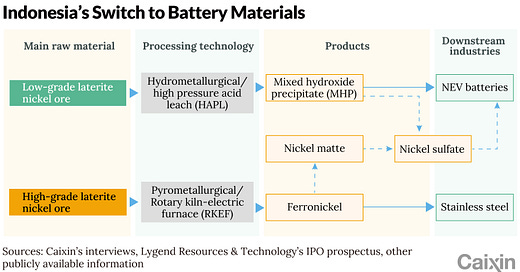

Nickel can be extracted from nickel ore either by a pyrometallurgical or hydrometallurgical process. In conventional pyrometallurgical processing, the ore is calcined in a rotary kiln and smelted in an electric furnace to produce ferronickel. The ferronickel produced in pyrometallurgical processing has a lower nickel content, from 8% to 15%, and is mainly used in producing stainless steel. Pyrometallurgical processes are energy-intensive.

A production line using pyrometallurgical process at Tsingshan Park in Indonesia

In a hydrometallurgical process, mixed ore is heated and pressured in a titanium-clad autoclave by steam and sulfuric acid injection, and nickel and cobalt are extracted into an acidic solution together with iron and aluminum. The final products produced in this process have a much higher nickel content, from 35% to 65%, and are mainly used in making ternary batteries for electric vehicles.

As Indonesia has ferronickel overcapacity, the country is considering a ban on new pyrometallurgical nickel projects next year, Meidy of the miners association told Caixin. The government will steer new investment into hydrometallurgical process to meet the growing demand for EV batteries, she said.

A production line using hydrometallurgical process at Tsingshan Park in Indonesia

In 2021, China’s leading nickel trader, Lygend Resources & Technology Co. Ltd., built Indonesia’s first hydrometallurgical nickel project. Chinese mining company Zhejiang Huayou Cobalt Co. and metal recycling service provider GEM Co. Ltd. have since launched similar projects.

Among the Chinese companies entering the new race, Huayou Cobalt is the most aggressive. The company in September 2022 clinched a deal with the Indonesian nickel unit of Brazilian mining giant Vale S.A. to build a second plant in the country that uses the high-pressure acid leach process to refine the metal. Huayou is expected to invest $7 billion in Indonesian nickel projects, the company’s chairman Che Xuehua told Caixin.

The expansion is intended to discourage the entry of new competitors. “If they don’t expand now, others will,” a person familiar with Huayou said.

But a new round of overcapacity is already starting to show in the hydrometallurgical segment. Antaike

As of mid-2023, Indonesia had 1.03 million tons of established and planned hydrometallurgical nickel capacity, which is more than twice the demand for battery nickel in 2022, according to Chinese state-backed research house Antaike.