CX Daily: As Tencent Lays Off Staff, Is Its ‘Winter’ Approaching?

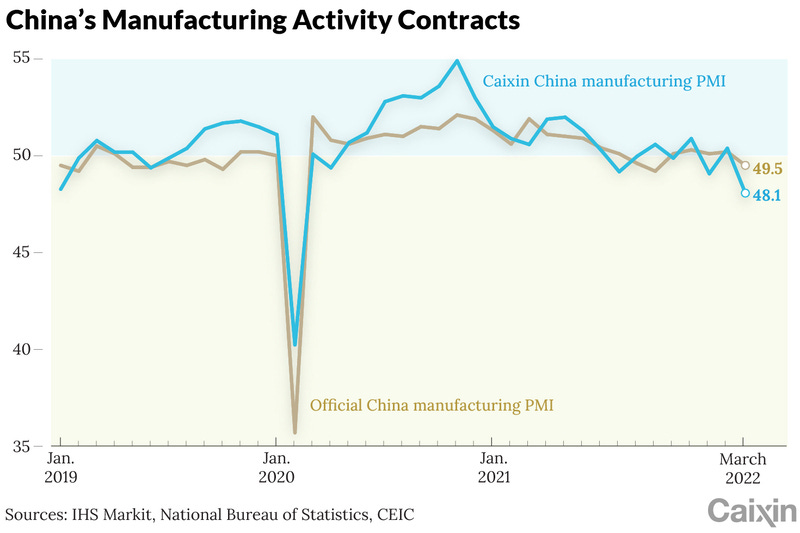

China’s manufacturing activity slumps to a two-year low, Caixin data shows.

Top Stories

Tencent headquarters in Shenzhen, Guangdong province. Photo: VCG

Tencent /

In Depth: As Tencent lays off staff, is its ‘winter’ approaching?

Tencent — the operator of China’s unassailable WeChat super-app, the world’s largest video game publisher and one of Asia’s most valuable companies — is firing staff.

On the tech conglomerate’s latest earnings call March 23, President Martin Lau acknowledged that the industry faces “fundamental changes and challenges” after years of “frothy and unhealthy” growth.

Tencent’s CEO and co-founder Pony Ma was blunter at an internal meeting in December, saying “winter is coming” for the company.

Covid-19 /

Shanghai bungles basics as outbreak pushes Covid strategy to the limit

Shanghai is running short of medical staff and supplies amid a surge in Covid-19 cases as some patients in quarantine facilities struggle to access medical care and daily necessities and others awaiting transfer are stranded at home.

The city of 25 million, once a model in China’s anti-Covid fight, is finding it hard to contain its worst-ever outbreak of Covid-19, driven by the highly contagious omicron variant.

Opinion: In crisis mode, Shanghai should stick to Zero-Covid approach

PMI /

China manufacturing activity slumps to two-year low, Caixin PMI shows

Activity in China’s manufacturing sector contracted at the steepest pace in 25 months in March, a Caixin-sponsored survey showed Friday, as restrictions aimed at containing a fresh wave of Covid-19 outbreaks hit supply and demand while the war in Ukraine hurts export orders.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, fell to 48.1 from 50.4 in February. Readings of less than 50 signal contraction.

Dialogue /

Ukraine war complicates battle to tame inflation, economists say

As China hunkers down to fight its ongoing wave of Covid-19 outbreaks and the U.S. and some European countries move to tackle rising inflation, uncertainties brought forth by the Russia-Ukraine war have complicated the work of central bankers in pushing for economic growth, according to two influential economists.

If not for the war, the U.S. could have tamed inflationary pressure in two or three years through a gradual tightening of monetary policy, Nobel laureate economist Christopher Pissarides said March 21 in an interview with Caixin.

Wang Tao, head of China economic research at UBS Investment Bank, said the economic war being waged in the form of sanctions on Russia has made the job of global policymakers harder.

Housing /

Chinese homebuyers shun market despite government revival efforts

China’s property market remained in the deep freeze in March even as the government signaled its support for the real estate sector and more cities relaxed administrative curbs to stimulate homebuying.

Contracted sales by the country’s 100 largest property developers fell 52.7% by value in March from a year earlier, a steeper decline than in January and February, data released by consultancy China Real Estate Information Corp. (CRIC) Thursday show.

Quick hits /

China’s deposit insurance fund had $15.14 billion balance at year-end

Pollyanna Chu, head of Macao Golden Group

Gambling /

Macao gambling junket operator Golden Group shuts down

Macao Golden Group became the latest junket operator to shut down in Macao as Beijing steps up oversight of cross-border online gambling.

In a memo to staff Sunday, the junket operator said the decision followed “careful consideration” and went into effect March 30. An insider from the Macao casino industry confirmed the memo to Caixin.

Golden Group was founded by Lee Wai Man, a gambling industry veteran who has close ties to local casino tycoon Stanley Ho. He started his fortune by operating high-roller rooms at Ho’s casinos. Now Golden Group is run by Lee’s daughter Pollyanna Chu.

Freight /

Freight prices to Shanghai surge as Covid curbs upend trucking market

The market for hauling goods on trucks into Shanghai — one of China’s main export gateways — has gotten so out of whack that some logistics companies are refusing to route through the Covid-stricken city, with one saying it won’t even quote customers a price.

The chaos in the Shanghai freight market comes as measures to curb the financial capital’s worst-ever Covid-19 outbreak continue to squeeze the flow of goods into and out of the city.

Syngenta /

Agriculture giant Syngenta’s revenue surges on China growth

Syngenta Group posted strong revenue growth in 2021 as the global agricultural technology giant owned by a Chinese state-owned enterprise benefited from surging sales in the country.

Sales of the Switzerland-headquartered company rose 23% to $28.2 billion last year, compared with a 5% rise in 2020, according to a statement issued Thursday.

Vaccines /

Sinovac’s Covid-19 vaccines give big boost to shareholders' profits

Covid-19 vaccines made by Sinovac Life Sciences Co. Ltd. made a big contribution to profit growth of the Chinese vaccine-maker as well as its shareholders last year.

Chinese pharmaceutical giant Sino Biopharmaceutical Ltd., which holds a 15% stake in Sinovac, said in its annual report released Thursday that major associates and joint ventures as a whole contributed 12.4 billion yuan ($1.9 billion) to company’s net profit last year, with Sinovac performing “particularly well” as it has supplied 2.7 billion doses of Covid-19 vaccines worldwide.

Quick hits /

Chairman and CEO of Perfect World Pictures dies at 48

Superstar Jay Chou’s mom plans bulletproof coffee brand IPO

China Oceanwide exits New York City and Hawaii to focus on LA

Tech Insider /

Baidu weighs delisting risk, Alibaba invests in smart glasses