The PBOC is moving to the next phase of driving fintech growth, giving full play to data and innovation to benefit the economy while also improving regulation to stamp out risk and malfeasance, and ensure that laws on data security and privacy are obeyed. Photo: VCG

Fintech /

In Depth: China’s fintech plan part two puts data, risk control in driving seat

As China puts the digital economy and all things data at the heart of the country’s development strategy for the next five years, expanding and regulating the fintech sector in a way that controls risks and avoids the chaos of the past few years will be a key part of the initiative.

The People’s Bank of China (PBOC), which oversees the industry, announced Jan. 4 its roadmap for developing fintech and driving the digital transformation of finance. The four-year plan will have profound implications for how the sector grows over the medium term for traditional banks and insurers and for fintech giants such as Ant Group Co. Ltd. and Tencent Holdings Ltd.

Covid-19 /

China considers ‘China-style’ strategy to coexist with Covid, top disease experts say

China has been assessing whether to adopt a strategy of coexistence with Covid-19 that best suits its own circumstances as it looks toward possibly reopening the country in the near future, according to top infectious disease experts.

Zeng Guang, a member of a high-ranking expert group at the National Health Commission (NHC), said in an article posted on his Weibo account Monday: “In the near future, at an appropriate time, [China] will release its roadmap for a China-style coexistence plan with the virus.”

FINANCE & ECONOMY

Payment /

Analysis: China’s CIPS won’t rescue Russian banks from SWIFT ban

Will China’s homegrown mechanism or some other alternative enable Russia to cushion the impact of being cut off from the world’s biggest interbank payment messaging system?

While some analysts say China’s system will get a boost, many experts argue it doesn’t have the capacity to fully replace the messaging mechanism of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) used by financial institutions around the world for cross-border payments.

The European Union (EU), the U.S. and several other Western countries decided to kick certain Russian banks out of the SWIFT system to punish the country for its attack on Ukraine, according to a joint statement issued Saturday. They also announced restrictions on the Russian central bank’s international reserves.

Opinion: Cutting Russia off from SWIFT isn’t an economic ‘nuclear bomb.’ isolating it from the global economy is

Regulator /

Ant Group’s self-inspection almost done, banking regulator says

The overall progress of rectification work at Ant Group Co. Ltd. has been smooth, said Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, as regulators continue to implement sweeping restructuring plans imposed on 14 fintech companies to overhaul their financial businesses.

Ant Group’s self-inspection work is nearly complete, but there are still some issues to be resolved, Guo told a press conference Wednesday. He added that while the country encourages financial innovation, laws and regulations must be followed to ensure fair competition and avoid the disorderly expansion of capital.

Quick hits /

Caixin New Economy Index rises as labor inputs grow

Ukraine raises equivalent of $277 million from sale of war bonds

BUSINESS & TECH

Freight /

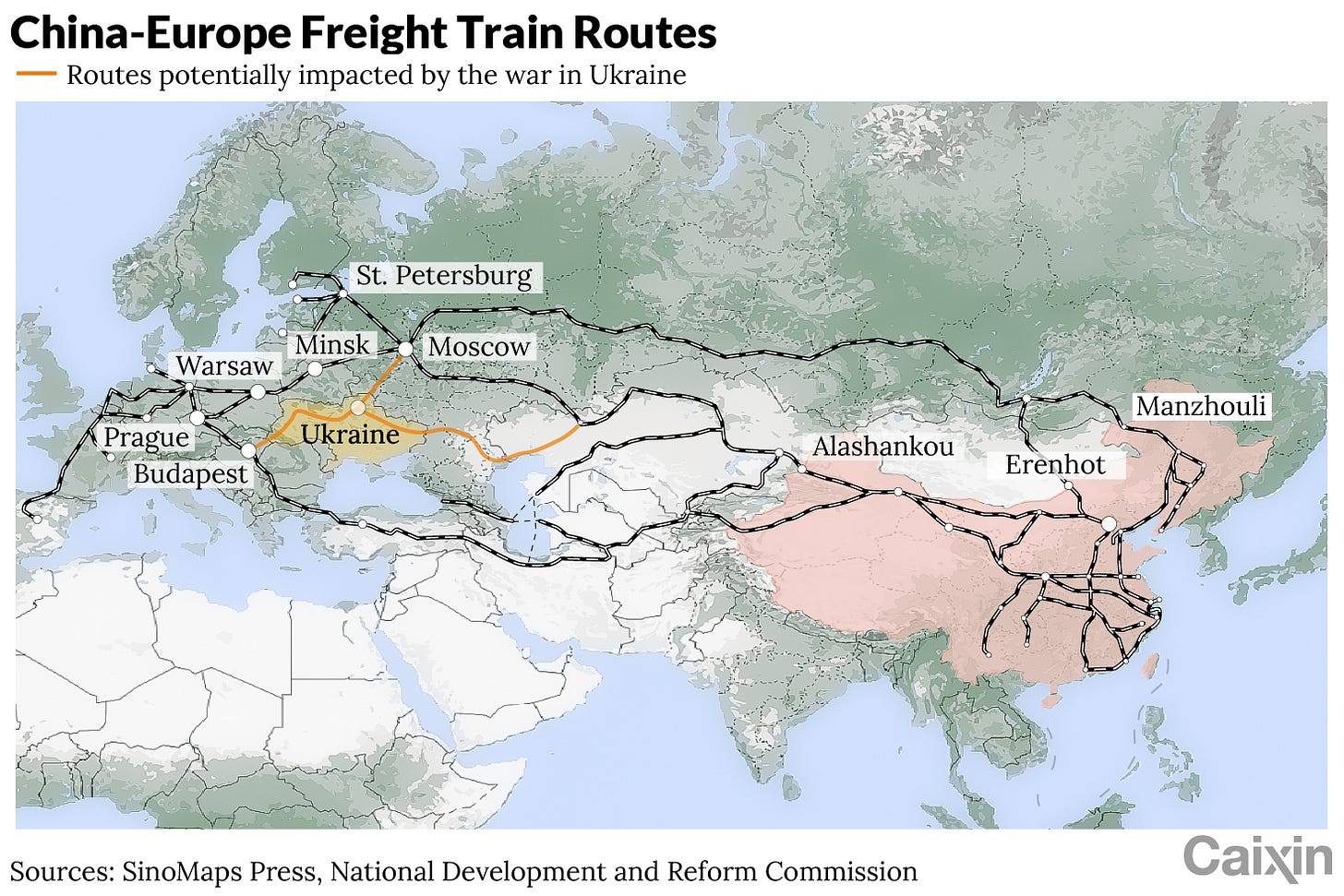

War in Ukraine disrupts some China-Europe freight trains, industry sources say

Most China-Europe freight train services were operating normally Wednesday amid the Russia-Ukraine conflict, though some were being diverted away from minor routes through the besieged city of Kyiv and others halted, industry insiders told Caixin.

“Over 98% of the trains head to EU countries pass through Russia, Belarus and Poland,” said Xu Yingming, the deputy director of the International Market Institute with the Chinese Academy of International Trade and Economic Cooperation of the Ministry of Commerce.

Meituan /

Meituan to lower fees for Covid-struck merchants, in line with government demand

Shares of Meituan rose 1.73% Wednesday after the Chinese food delivery giant said it would do as the government asked and lower commission fees for merchants using its platform in Covid-hit areas.

In February, the National Development and Reform Commission, China’s top economic planner, issued guidelines that required online food delivery platforms to give preferential service fees to restaurants in regions affected by outbreaks.

Earnings /

IQiyi shares jump on rosy earnings outlook despite widening quarterly loss

Shares of iQiyi Inc. surged by almost 40% Tuesday after the video streaming platform offered a sunnier outlook for the coming quarter in its latest earnings report.

The Nasdaq-listed firm gave back about half of those gains over the course of the day, closing 21.5% higher at $5.03 a share.

CEO Gong Yu talked up the financial prospects of the company's subscription model amid China’s improving copyright protection environment and increased use of screens in smart cars. Administrative costs are also expected to drop in the first quarter after widespread layoffs in December.

Quick hits /

Central China metropolis eases homebuying rules to jolt sluggish local market

Baidu’s sales beat estimates after cloud arm offsets China slowdown

China’s 51job agrees to accept lower buyout bid of $4.3 billion

GALLERY

Russian airstrikes on Ukrainian cities intensify