CX Daily: China’s Planned Revamp of Trust Bailout Fund Draws Questions

Elderly Covid-19 patients in Shanghai have a hard time coping with centralized quarantine.

TOP STORIES

Trust /

In depth: China’s planned revamp of trust bailout fund draws questions

After Anxin Trust Co. Ltd. (600816.SH) found itself teetering financially in 2018 due to devastating losses on risky investments and shady business practices, it turned to China’s state-backed trust protection fund for help.

In the first half of 2019, the onetime darling of China’s trust industry borrowed 6.85 billion yuan ($996 million) from the fund and its manager, China Trust Protection Fund Co. Ltd. (CTPFC). At the end of June that year, the amount unpaid was 5.65 billion yuan, which was due to be repaid between July 2019 and June 2020, according to Anxin’s exchange filings. However, the company ended up defaulting on all of the outstanding loans.

As part of a state-backed restructuring plan, Anxin announced in July 2021 that it would sell a controlling stake to a newly formed company whose shareholders included CTPFC.

Covid-19 /

Shanghai’s elderly Covid patients have a hard time coping with centralized quarantine

In the early hours of Tuesday, Zhiye’s 94-year-old grandmother was taken away from her home. “They pried open our door,” she said. Her uncle called her at 2:47 a.m. Tuesday, but his voice was drowned out by the chaos at the other end.

Zhiye’s uncle, 74, was locked down in his home with her grandmother since the end of March due to Covid cases being found in their residential complex, Yichuan Sicun in Putuo district, Shanghai. On April 13, the two took antigen tests and both were positive. The next day, the neighborhood committee came to administer polymerase chain reaction (PCR) tests, but no results have been reported since.

Initial public offerings on Wall Street and in Hong Kong are the main routes for private equity funds to exit investments.

Funds /

Private equity funds slow pace amid rising uncertainties

Private equity funds dominated by foreign currencies slowed their fundraising in China amid growing uncertainties about the ability of Chinese companies to sell stock abroad ― the main exit channel for investors to harvest gains.

Twenty foreign currency-based private equity funds launched fundraising campaigns in the first quarter, 57.4% fewer than a year ago, according to research institution Zero2IPO. The amount of money raised declined 62.6% to 31.5 billion yuan ($4.9 billion), data from Zero2IPO showed.

The shrinking size of foreign currency-dominated funds reflects investors’ concerns over narrowing exit paths, Zero2IPO said. Initial public offerings on Wall Street and in Hong Kong are the main routes for such funds to exit investments.

Huarong /

Exclusive: China Huarong chairman takes the reins at another bad-debt manager

The chairman of China Huarong Asset Management Co. Ltd. took a leadership position at another state-owned asset management company (AMC), Caixin learned, marking a major personnel move at the scandal-plagued bad-debt manager.

After four years at Huarong, Wang Zhanfeng has moved to head China Orient Asset Management Co. Ltd., another “Big Four” bad-debt manager, sources with knowledge of the matter told Caixin.

Insurers /

Ping An unit looks to beef up private pension business with fresh funds, sources say

The pension-focused subsidiary of Chinese insurance giant Ping An Insurance (Group) Co. of China Ltd. is planning to boost its private pension business with part of the new capital it is raising, sources familiar with the company told Caixin.

Ping An Annuity Insurance Co. of China Ltd. announced Sunday that it is raising 10.5 billion yuan ($1.6 billion) from its parent to “to support business development,” without elaborating.

Quick hits /

IMF slashes growth outlook on Russia invasion, China lockdowns

Chinese yuan extends drop to six-month low as U.S. yields rise

China and Solomon Islands sign security pact

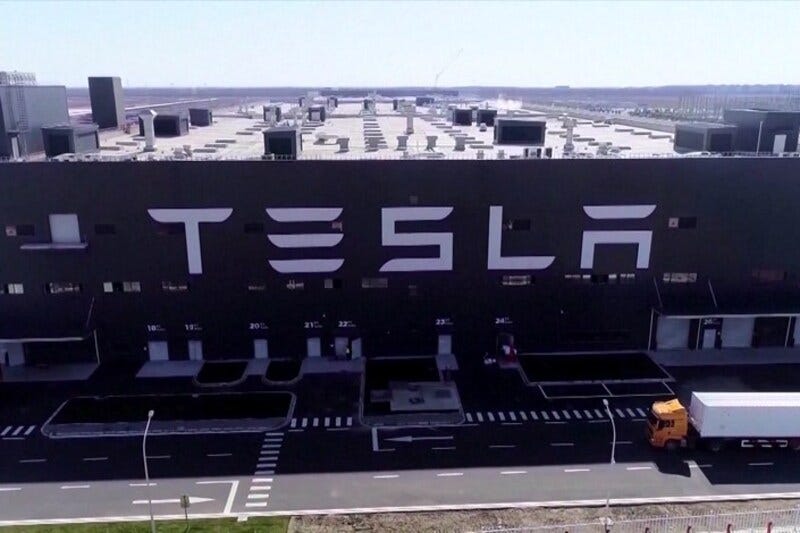

The Tesla Gigafactory in Shanghai. Photo: VCG

Tesla /

Tesla’s Shanghai plant reopens after three-week Covid closure

U.S. electric-vehicle maker Tesla Inc. resumed production at its Shanghai plant, ending a three-week suspension as authorities in the city work to bring industrial operations back to normal amid its worst ever Covid-19 outbreak.

The news, which was announced in a social media post published by Tao Lin, Tesla China’s vice president for external affairs, came after the Shanghai government laid out guidelines to encourage more than 600 local businesses to resume production.

The Shanghai plant, which makes Model 3 sedans and Model Y SUVs, suspended production on March 28 after the city unveiled plans to impose a two-phase citywide lockdown to curb a dramatic surge in Covid-19 infections. The facility also temporarily halted production on March 16 and March 17.

BMW, Bosch restart production lines in China as lockdowns ease

Highway /

China’s Covid controls take a heavy toll on highway traffic

Highway traffic volume in China’s Yangtze River Delta — one of the country’s wealthiest regions — has plunged after local governments shut roads as part of efforts to contain a severe wave of Covid-19.

On Monday, Shanghai and the provinces of Jiangsu, Zhejiang and Anhui registered a 65% year-on-year plunge in their highway traffic volume and a 21% drop in truck volume, Wu Chungeng, head of the Ministry of Transport’s road bureau, said at a Tuesday press conference.

Overall, China’s highway traffic plummeted nearly 40% that day compared with a year ago. But “as more highway rest areas and toll gates resume operations, the traffic volume will gradually rebound,” added Wu.

Property /

China’s real estate woes push property services firm to default on dollar bond

Real estate services provider E-House (China) Enterprise Holdings Ltd. defaulted on a $298 million U.S. dollar bond after getting caught up in the financial troubles of several property developers, it said in an exchange filing.

The default on the 7.625% bond, which was due Monday, triggered a cross-default on a $300 million note due in 2023.

Last year, E-House reported an 8.9 billion yuan ($1.4 billion) net loss attributable to shareholders, a reversal from a 304.4 million yuan net profit posted in 2020.

Quick hits /

Central SOEs post slower growth in first quarter

Opinion: China’s Covid-19 mRNA vaccine challenge