CX Daily: Four Things to Know About Chinese Policy Banks’ Extra $120 Billion for Infrastructure

Hong Kong and the Chinese mainland will launch the ETF Connect program July 4. Nio denies claims of inflating its revenue and profit

A bridge project in Guangyuan, Sichuan province, on June 16. Photo: VCG

Infrastructure /

Four things to know about Chinese policy banks’ extra $120 billion for infrastructure

As downward pressure on China’s economy intensifies, the government is enlisting policy banks in an infrastructure investment drive that it hopes will buoy growth.

An 800 billion yuan ($120 billion) increase in policy banks’ lending quota to support infrastructure investment was announced at the June 1 executive meeting of the State Council, China’s cabinet. The meeting, chaired by Premier Li Keqiang, also urged officials to speed up the implementation of a stimulus package announced previously.

Manufacturing /

Cambodia and Myanmar race to become the next apparel manufacturing hub

As China battled a wave of Covid-19 flare-ups over the past few months with strict control measures, the widespread disruption of business operations fueled concerns over an accelerating exodus of manufacturing.

From October 2021 to March 2022, China lost around 5% of its textile export orders, 7% of its furniture and 2% of its mechanical and electrical export orders from the United States to the 10-member Association of Southeast Asian Nations (ASEAN), especially Vietnam, according to U.S. customs data.

FINANCE & ECONOMY

Laos /

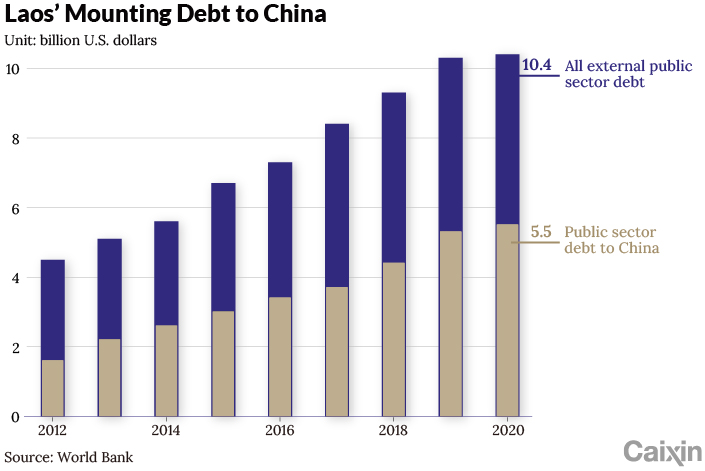

Charts of the Day: China looms large in Laos debt crisis

Laos could be teetering on economic collapse, triggering concerns of a sovereign default to creditors including China.

The Southeast Asian nation is suffering from mounting debt, rampant inflation and a plunging currency. Its struggles have been likened to Sri Lanka’s economic woes.

At the end of 2020, Laos had $5.5 billion in outstanding public sector debt owed to neighboring China, an increase of 4% from a year earlier, according to World Bank data. That accounted for more than half of Laos’ external public sector debt, making China its largest single creditor.

ETF /

Hong Kong and China mainland to launch ETF Connect July 4

Chinese and Hong Kong securities regulators jointly announced plans Tuesday to launch a system to allow eligible investors in the city and the mainland bourses in Shanghai and Shenzhen to buy and sell exchange-traded funds (ETFs) in each other’s markets.

Under the ETF Connect program, trading of eligible funds will start July 4, the Hong Kong Securities and Futures Commission (SFC) and the China Securities Regulatory Commission (CSRC) said.

Corruption /

Former ICBC banker pleads guilty to taking $15 million of bribes

Lu Jinwen, a former vice president of the Guangdong branch of Industrial and Commercial Bank of China Ltd. (ICBC), pleaded guilty to taking 100 million yuan ($14.9 million) of bribes.

A court in Shandong province heard Lu’s case Thursday. Lu, 60, was charged with bribery and illegal loan issuance. The court said sentencing would take place on a later date.

Quick hits /

China vows to ensure growth and block inflation

BUSINESS & TECH

Shanghai-based Nio is one of China’s most valuable EV manufacturers. Photo: VCG

Short-seller /

Nio denies claims of dodgy accounting as stock tumbles

Shares of Nio Inc. plunged Wednesday after a notorious U.S. short-seller alleged that the Chinese electric-vehicle maker was exaggerating its revenue and profitability by selling to a related company.

In a report released late Tuesday, Grizzly Research LLC claimed that the startup used a battery asset management affiliate to help inflate its revenue and net income by 10% and 95%, respectively, in the first nine months of 2021.

Evergrande /

Evergrande says HK investor’s lawsuit won’t affect debt restructuring timetable

An overseas-registered company reportedly owned by Hong Kong businessman Lin Ho Man is demanding the liquidation of heavily indebted China Evergrande Group, the Chinese developer disclosed Tuesday in a statement.

Top Shine Global Ltd. of Intershore Consult (Samoa) Ltd., a Samoan Islands-registered holding company, filed suit Friday in Hong Kong’s high court. The company asked the court to order the liquidation of Evergrande’s assets to honor a repurchase agreement signed last year as part of its fundraising for an online real estate and automobile marketplace, an unnamed Top Shine executive told Reuters.

Tourism /

Chinese travel industry stocks take off after quarantine rule change

Stock investors have warmed to China’s tourism industry, with shares of some bigger names in the business rising 10% or more since Tuesday when the government made a surprise announcement cutting the amount of time arriving overseas travelers have to spend in quarantine.

The surge in share prices reflects some newfound optimism in an industry that has been battered by the pandemic as China largely closed its borders to international travelers and at times imposed domestic travel restrictions on people from areas hit by outbreaks of Covid-19.

Quick hits /

Globalwafers to move into U.S. with new plant

China’s property market has bottomed out, top developer says

Former Apple camera-module supplier removed from U.S. trade blacklist

GALLERY