CX Daily: How ‘Judicial Brokers’ May Have Swayed a Ruling by China’s Top Court

A former president of China Merchants Bank is investigated for suspected corruption.

TOP STORY

Shen Deyong, a former vice president of the Supreme People’s Court. Photo: VCG

Corruption /

In Depth: How ‘judicial brokers’ may have swayed a ruling by China’s top court

The graft investigation of a former Supreme People’s Court vice president that involves three of his former top aides may be related to a controversial, 700 million yuan ($109 million) equity ownership lawsuit, according to people with knowledge of the matter.

In a surprise 2014 ruling, the Supreme Court overturned a lower court’s finding in a dispute over a stake in Hong Kong- and Shanghai-traded, state-owned New China Life Insurance Co. Ltd. that dragged on for 11 years. The story behind the ruling — since treated as a landmark precedent — has never been completely uncovered.

Now the probe by China’s top anti-corruption watchdog may shed light on what some say is the seamy underside of China’s judicial system.

China’s Futures and Derivatives Law was approved Wednesday.

Futures /

Three things to know about China’s new futures law

China passed its long-awaited Futures and Derivatives Law, aiming to better regulate the burgeoning market and bring rules more in line with international norms.

The law (link in Chinese) — China’s first to specifically regulate the futures and derivatives sector — was approved Wednesday by the National People’s Congress’s Standing Committee, the national legislature’s decision-making body. It will go into effect Aug. 1.

The law stipulates trading, settlement and delivery rules for futures and derivatives and bans behaviors such as insider trading, market manipulation, and fabricating and spreading false or misleading information.

Banking /

Ex-president of China Merchants Bank investigated for suspected corruption

China’s top anti-graft watchdog said Friday that Tian Huiyu, a former president of China Merchants Bank Co. Ltd. (CMB), is under investigation for suspected severe violations of law and Communist Party discipline — a euphemism for corruption.

The bank said Monday that Tian had been removed from his position, prompting its Shanghai- and Hong Kong-listed shares to drop over the next two days.

Default /

Exclusive: State creditors sue embattled Cedar over bond default

Two state creditors took Cedar Holdings Group Co. to court after the debt-ridden commodity giant missed interest payments last month on 8 billion yuan ($1.24 billion) of debts.

The suits against Cedar were filed with the Guangzhou intermediate court and demanded a freeze on the company’s assets, Caixin learned from people familiar with the matter. The plaintiffs are Guangzhou city government-backed Guangzhou Xinhua City Development Industry Investment Enterprises (L.P.) and Guangzhou Kaidi Financial Holding Co. Ltd.

Covid-19 /

Shanghai ups citywide testing regime in effort to become Covid-free

Shanghai has reintroduced citywide high frequency Covid testing in a push to clear positive cases at the community level “as early as possible,” according to the local government, after two districts reported no additional infections Thursday.

Starting Friday, residents confined to their homes have to take daily nucleic acid tests, while residents who are only confined to the premises of their communities will be subject to two days of the tests and three days of antigen tests, the local government said in a statement, without elaborating on when the Covid testing drive would end.

Hong Kong begins slow reopening with finance hub status at stake

Quick hits /

China urges big investors to buy stocks after market tumbles

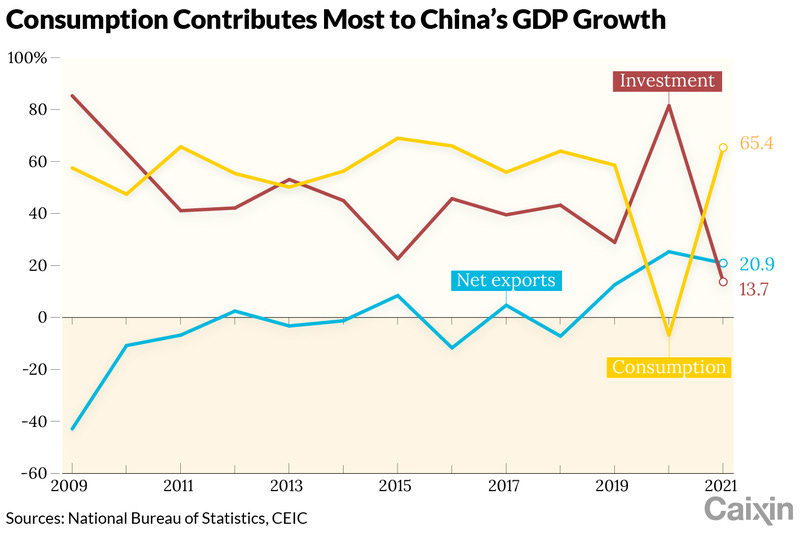

PBOC chief Yi Gang says monetary policy is helping support the economy

Opinion: Yuan’s share of global forex reserves will eventually surpass yen, sterling

Farmers plow a field in Shulan, Northeast China's Jilin province, on May 9, 2021. Photo: VCG

Jilin /

China’s Covid controls are disrupting spring planting

Jilin, a major agricultural province in China’s northeast, is struggling to stabilize its crop production, especially corn, as strict anti-Covid measures have hampered the movement of farmers and materials, threatening spring planting.

The spring cultivation period has begun, but farmers and industry insiders told Caixin that Jilin faces labor shortages and many farmers are finding it hard to secure supplies such as seeds, fertilizer and pesticides from both inside and outside the province.

Since the beginning of March, Covid restrictions to control the stealthy omicron variant have disrupted transportation and confined millions of people to their homes. Jilin, among the hardest-hit regions, put all of its 24 million residents under lockdown in mid-March after a spike in cases.

Nuclear /

China OKs six new nuclear reactors

Beijing gave the green light to the construction of six new nuclear reactors, which analysts estimate will involve some 120 billion yuan ($18.6 billion) of investment.

The new nuclear power investment comes as China works toward its plan of peaking carbon emissions by 2030 and reaching net-zero emissions by 2060.

Quick hits /

Tesla supply chain snarls belie Musk’s bullish Shanghai posture

Tech Insider /

Xiaohongshu slashes workforce, Didi scales back in Japan