CX Daily June 11: China’s Struggle to Rev Up Credit Demand

China’s policymakers are facing an uphill battle to revive borrowing demand, as the country slowly

Lack of credit demand could severely hinder economic expansion as individuals and businesses are reluctant to take out loans.

Credit /

In Depth: China’s struggle to rev up credit demand

China’s policymakers are facing an uphill battle to revive borrowing demand as the country slowly emerges from Covid-19 lockdowns that shattered consumer and business confidence.

The lull in borrowing became more pressing following the release of dismal credit data for April, even as the central government deployed a series of easing measures including cutting interest rates to bolster the sluggish economy.

In April, financial institutions issued just 645 billion yuan ($94.9 billion) in net new yuan loans, the lowest since December 2017, according to data released by the People’s Bank of China (PBOC) May 13. That’s a sharp decline from 3.1 trillion yuan in March.

FINANCE & ECONOMY

Ant has been carrying out a comprehensive business overhaul under the guidance of regulators.

Ant /

Alibaba rally fizzles as regulators squelch report of Ant IPO revival

China’s top securities regulator said it is not working on a revival of Ant Group’s listing plan, denying a news report that spurred a surge in stockholder Alibaba Group Holding Ltd.’s shares.

The China Securities Regulatory Commission (CSRC) is not conducting a review and research work on an initial public offering for Ant, the commission said Thursday in a statement. The CSRC said it supports qualified platform companies to sell shares at home and abroad.

Ant, the fintech giant controlled by Alibaba founder Jack Ma, said in a statement that it has no plan to restart an IPO while working with regulators on business restructuring.

Banking /

Scandal-plagued China Huarong sells $1.8 billion stake in regional lender

Debt-ridden China Huarong Asset Management Co. Ltd. said it agreed to sell its stake in a regional commercial bank as the embattled firm continues to offload assets and restructure its sprawling business.

Huarong signed a contract with a consortium consisting of Hunan Chasing Financial Holding Group Co. Ltd. and Central Huijin Investment Ltd. to sell them its holdings in Huarong Xiangjiang Bank Corp. Ltd., according to the company’s filing Thursday with the Hong Kong Stock Exchange.

Insurers /

Tianan Property Insurance offers its assets for $314 million

Tianan Property Insurance Co., a government-seized affiliate of Tomorrow Holding, put up its assets for sale as regulators unwind the troubled conglomerate’s sprawling empire.

Tianan listed its insurance assets at the Shanghai United Assets and Equity Exchange Thursday, seeking bidders with an asking price of 2.1 billion yuan ($314 million). The assets for sale include Tianan’s financial and nonfinancial assets, liabilities and insurance businesses, according to public information. Tianan also demanded that potential buyers take on its employees unconditionally.

Covid-19 /

Beijing reimposes Covid restrictions as nightlife cluster emerges

Beijing reimposed tough Covid measures in its most populous district, including closing entertainment venues, after a growing cluster of infections linked to bars ended a five-day streak of no community spread.

Nearly 30 Covid patients, detected in 12 of the city’s 16 districts between Thursday and Friday afternoon, were found to have links with Heaven Supermarket, a bar near the Worker’s Stadium in Chaoyang district, authorities said Friday at a press conference. Of them, 26 visited the bar early this week, authorities said.

Beijing intensifies Covid lab inspections amid testing fraud

Covid-free Chinese regions cautioned on excessive mass testing

Quick hits /

China’s exports rebound as threat of broader slowdown looms

China factory inflation moderates as commodity prices cool

BUSINESS & TECH

Testing /

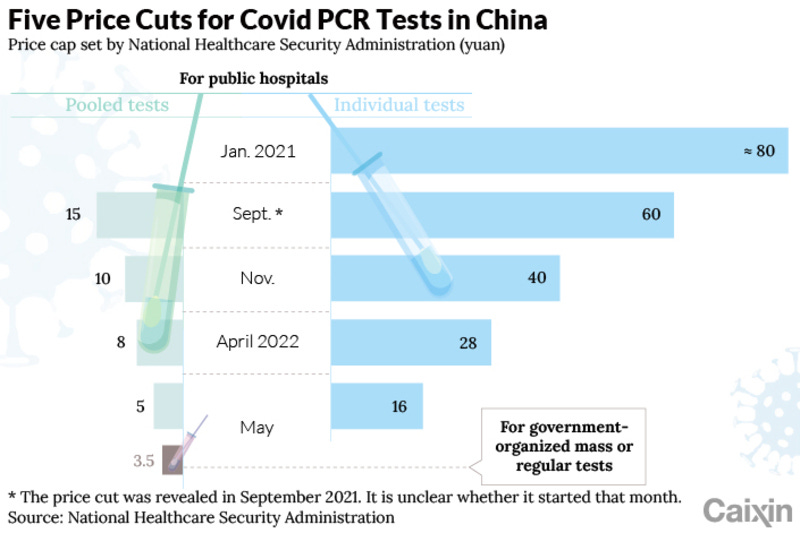

Analysis: China’s Covid test firms wave goodbye to the days of easy money

Chinese Covid-19 test companies are facing shrinking profits despite higher demand as the government further cut prices and competition grew fiercer.

As regular testing becomes the new norm, demand for the service has never been greater, which is a boon to test companies. However, as local government budgets come under higher pressure, authorities have slashed the prices test companies can charge.

Huawei /

Huawei vows to step up domestic patent licensing

Huawei Technologies Co. is stepping up efforts to turn its vast pool of patents into revenue through licensing arrangements with domestic companies as the telecommunications giant seeks to offset the effects of U.S. sanctions.

Huawei is communicating with domestic companies on patent licensing and expects to reach agreements in the near future, Fan Zhiyong, head of Huawei’s intellectual property rights department, told Caixin.

Logistics /

China’s Uber for trucks shrugs off cybersecurity probe to report market-beating quarter

Full Truck Alliance Co. Ltd., which operates Chinese truck-sharing apps, posted a better-than-expected first quarter result Wednesday, with revenue surging 53.7% year-on-year to 1.3 billion yuan ($194 million) and the net loss shrinking by 2.5% to 192 million yuan.

The NYSE-traded tech firm, also known as Manbang, attributed the strong performance to revenues generated from freight matching services — the core service offered by their apps — which rose 61% year-on-year to 1.1 billion yuan, despite typically lower seasonal demand and transportation bottlenecks caused by pandemic restrictions.

Quick hits /

Drone maker DJI supplies smart driving system to SAIC-GM-Wuling

Tesla’s China factory roars back with output tripling

Tech Insider /

Probed trucker reports bumper growth, BYD in Tesla talks, exec says