CX Daily: The Sweeping Impact Of New U.S. Semiconductor Restrictions

Xi calls on all Communist Party members to build China into an all-round modern socialist country by mid-century

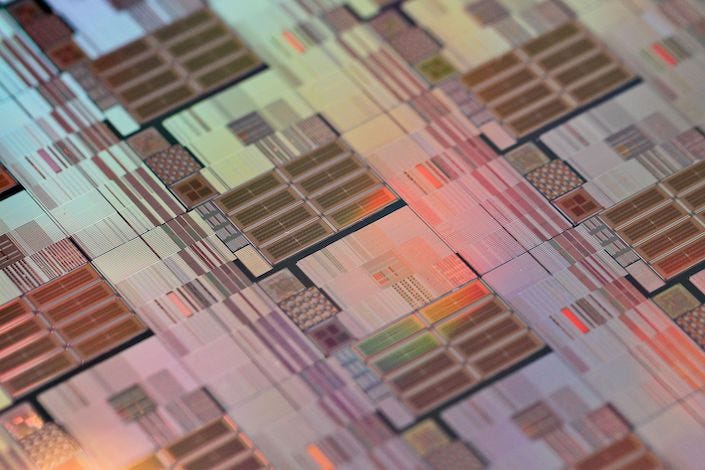

Chips /

Cover Story: The sweeping impact of new U.S. semiconductor restrictions

The Biden administration landed its heaviest blows yet in this month’s escalation of the U.S. war on China’s semiconductor ambitions. The sweeping new restrictions unveiled Oct. 7 affect not only the sale of advanced integrated circuits, sophisticated chipmaking equipment and supercomputer parts but also China’s ability to hire top talent.

In the short term, the restrictions will limit Chinese chipmakers’ ability to make certain types of electronic devices that are at the heart of modern products ranging from household appliances to mobile phones, smart electric vehicles and advanced military weapons. In the long term, the policies may spur China to try to accelerate its self-sufficiency drive in semiconductors and the equipment to produce them, industry experts say.

Editorial: How China should respond to ‘decoupling’

Congress /

Xi calls on Communist Party to build modern socialist China by mid-century

At the opening ceremony of the Communist Party’s 20th National Congress, President Xi Jinping called on all party members to build China into an all-round modern socialist country by mid-century and be prepared to withstand major challenges along the way.

In his speech to the twice-a-decade conclave, Xi said this modernization will be the central task of the party “from this day forward,” as it embarks on the “great and arduous undertaking” of advancing the rejuvenation of the nation through a “Chinese path of modernization.”

Hong Kong /

Hong Kong may deploy BioNTech’s omicron-specific shot next spring

Hong Kong is likely to offer BioNTech’s new Covid vaccine targeting omicron variants early next year as a booster shot for residents following recommendations from two government advisory panels.

Experts backed the German vaccine maker’s second-generation shot, which targets both the original strain of the virus and the omicron subvariants BA.4 and BA.5, to be used as a fourth dose for residents ages 12 or older.

FINANCE & ECONOMY

The China Securities Regulatory Commission headquarters in Beijing on May 16. Photo: VCG

Trading /

China to exempt certain foreign mutual funds from short-term trading rules, sources say

China’s securities regulator is drafting rules to exempt certain foreign mutual funds from tough regulations designed to limit short-term trading and prevent insider trading in its latest move to further open up the country’s capital market to overseas investors.

The China Securities Regulatory Commission (CSRC) is likely to allow overseas mutual fund products that hold 5% or more of a Chinese mainland-traded company to carry out short-term trading without giving up profits, sources close to regulators told Caixin.

GDP /

China delays release of third-quarter GDP figures indefinitely

China delayed the release of third-quarter GDP figures and a number of other economic indicators, originally scheduled for Tuesday, according to an updated calendar published by the National Bureau of Statistics (NBS) Monday afternoon.

The NBS hasn’t given any reason or published a new release date.

Economy /

China’s top central banker and finance minister vow support for economy

China will push banks to lend more to some sectors and speed up the rollout of existing economic support policies, the country’s central bank governor and finance minister said.

People’s Bank of China (PBOC) Governor Yi Gang reaffirmed a pledge to “step up the implementation of a prudent monetary policy and provide stronger help to the economy,” in a video speech Thursday at a meeting of the central bank governors of the Group of 20 countries.

Quick hit /

China rolls over policy loans with Party Congress underway

BUSINESS & TECH

Fosun cut holdings in at least eight publicly traded companies this year and will have cashed out nearly 40 billion yuan if the deal with Shagang Group is successful, according to Caixin calculations. Photo: VCG

Fosun /

Fosun to offload steelmaker stake for $2.1 billion as debts mount

Fosun International Ltd. is planning to sell its stake in a Chinese steelmaker to a private metals titan for around 15 billion yuan ($2.1 billion), according to sources with knowledge of the deal, which would net the debt-laden conglomerate much-needed liquidity.

Hong Kong-traded Fosun inked an agreement with steel giant Jiangsu Shagang Group to transfer its 60% shareholding in Nanjing Nangang Iron & Steel United Co. Ltd. Nangang owns 57.2% of Shanghai-listed Nanjing Iron & Steel Co. Ltd. (NISCO).

Property /

Shenzhen’s leased office space contracts in Q3, driving up vacancy rate

The net rental growth of Shenzhen’s prime office buildings slipped into negative in the third quarter, pushing up the vacancy rate to 22.7%, data from global real estate consultancy Cushman & Wakefield shows.

In the tech hub, there has been more drop-off and reduction in rental space of 21,000 square meters than those newly leased areas in Grade-A office buildings in the third quarter, according to the data.

Shipping /

Shipping companies cut services as freight rates plunge

International container shipping rates continue plunging amid weakening demand, prompting shipping companies to slash services.

The Shanghai Containerized Freight Index published by the Shanghai Shipping Exchange, the world’s most-used benchmark for sea freight rates, fell Friday to a reading of 1,814, down nearly 70% from the beginning of this year.

Quick hit /

China’s industrial robot firms see more orders from EV-makers

Long Read /

The rural hardship behind the mine murders that shocked China

GALLERY

Over 2,000 Party delegates arrive in Beijing