Free to read: Huawei Smartphone Shipments Surge, China Limits Facial Recognition at Hotel Check-In

Beijing approves U.S. listing for self-driving firm in sign of easing, Google-backed AI specialist is Hong Kong’s latest IPO flop

Customers line up to buy Huawei Pura 70 series phones at Huawei's global flagship store in Shanghai on Monday. Photo: VCG

【🍃Spring Sale 🌷30% off for a yearly subscription | $3.5/month💰】

Huawei’s smartphone shipments surge

Huawei Technologies Co. Ltd. was the fastest-growing smartphone brand in China in the first quarter, as its shipments surged 69.7% year-on-year, according to a new report. Huawei controlled 15.5% of the domestic smartphone market, taking the title of the country’s No. 4 vendor, up from the sixth place in the same quarter of 2023, according to a report published Tuesday by Counterpoint Research. Counterpoint attributed Huawei’s growth to its “successful launch of the 5G-capable Mate 60 series,” which helped it gain a massive share of the $600-plus market segment.

China limits facial recognition at hotel check-in

Hotels in Beijing, Shanghai, Shenzhen and Hangzhou have been ordered by local authorities to stop scanning guests’ faces at check-in, Caixin has learned, as the government steps up protection of personal data amid growing use of facial recognition technology. A majority of the hotels contacted by Caixin said that they received notices in late March or early April from local police departments requiring them to let guests check in without using facial recognition, while some said that they had been asked to do so as early as 2023 — after Beijing lifted its “zero-Covid” policy. Hotels that haven’t removed facial recognition equipment are being told to manually enter guests’ personal information into their systems, Caixin has learned.

In sign of easing, China approves U.S. listing for self-driving firm

China has given the green light to a United States listing by the autonomous driving startup Pony.ai Inc., raising the potential for an increase in Chinese tech IPOs in New York after a two-year hiatus. Pony.ai plans to sell up to 98 million shares, according to an announcement on the China Securities Regulatory Commission’s website late Tuesday. The Chinese securities regulator said Friday it would support overseas listings of tech firms. Chinese IPOs in the U.S. slowed dramatically after Beijing tightened rules on listings.

Google-backed AI firm is Hong Kong’s latest IPO flop

Mobvoi Inc., a Chinese artificial intelligence developer backed by Alphabet Inc.’s Google, dropped as much as 22% in its first day of trading in Hong Kong, marking the third stock debut to flop in the city this week. The shares tumbled even after they were sold near the low end of the indicated price range for its IPO. The company and its shareholders raised HK$321 million ($41 million), much lower than the $200 million to $300 million it was said to be targeting last year. The slide also contrasted with gains in Hong Kong and Asian stocks markets Wednesday. Known for its Ticwatch smartwatches and Chumenwenwen voice-activated search services, Beijing-based Mobvoi was founded in 2012 by a group of former Google employees.

SenseTime halts trading after stock surges 36%

SenseTime Group Inc.’s stock soared its most in more than two years after releasing the latest version of its SenseNova generative AI model, highlighting the intense interest surrounding China’s efforts to develop artificial intelligence. The shares gained as much as 36% after the company revealed SenseNova 5.0 in Shanghai. The ChatGPT-like platform has “significantly” improved in terms of linguistic and creative capabilities, Chairman Xu Li said in a statement. Trading in the stock was suspended after the surge. SenseTime is among a growing number of Chinese companies exploring ways to develop an answer to OpenAI’s ChatGPT.

TikTok faces hurdles to becoming No. 1 in Vietnamese e-commerce, expert says

Regulatory risks could derail TikTok’s drive to become Vietnam’s No. 1 online marketplace, an industry expert said. The ByteDance Ltd.-owned short-video app launched TikTok Shop in the Southeast Asian country in April 2022 as part of its broader ambition to control 35% of the region’s e-commerce market. Since then, it has surpassed Alibaba Group Holding Ltd.-backed Lazada to become Vietnam’s second-largest online marketplace by gross merchandise volume — TikTok’s vendors sold about $1.3 billion worth of goods in the past six months, according to local media which cited data from local analytics firm Metric. Now, only Singapore-based Shopee stands between TikTok and the top spot.

Huawei launches new, cheaper version of the Aito M5 SUV

Huawei unveiled its latest version of the Aito M5 SUV on Tuesday in Beijing. The extended-range rear-wheel drive model now starts at 249,800 yuan ($34,465), down 30,000 yuan from its launch price in April 2023. The price of the all-electric version has been cut by 20,000 yuan to 269,800 yuan, and the extended-range four-wheel drive model by 20,000 yuan to 279,800 yuan. In addition, Huawei introduced the Stelato S9, a luxury sedan jointly developed with BAIC BluePark New Energy Technology Co. Ltd.. Yu Chengdong, chairman of Huawei’s smart car unit, said that this vehicle aims to compete with the BMW 7 Series and Audi A8, with a planned launch in the summer.

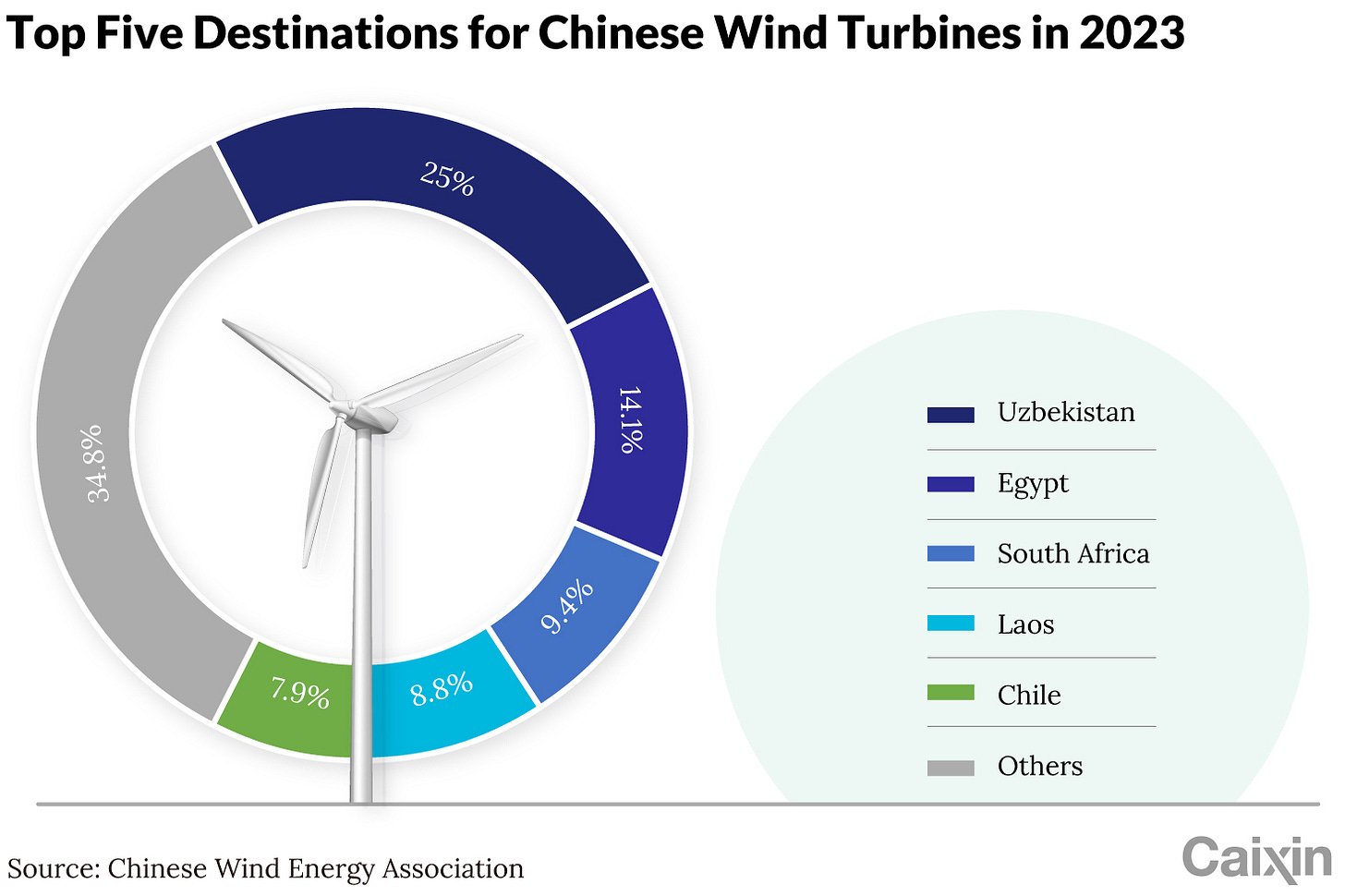

China wind turbine exports surged 60% last year

Chinese wind turbine exports surged more than 60% in 2023, with manufacturers shipping more than 3.6 gigawatts as they look for new growth in overseas markets, according to a new report. The locally made turbines were exported to 18 countries, with Uzbekistan, Egypt, South Africa, Laos and Chile being the top five buyers in 2023, accounting for more than 65% of the total, according to a report published Friday by the Chinese Wind Energy Association. The top five destinations of Chinese wind turbines are all countries involved in China’s Belt and Road Initiative.

Smart cars, smartphones, smart moves

First, Chinese carmaker Nio Inc. released a smartphone. Then tech giant Xiaomi Corp. launched an electric vehicle. Now, Swedish carmaker Polestar is joining the fray with its own phone for the Chinese market, where high-tech and highly connected offerings are popular with drivers. Unveiled in Beijing Tuesday in the run up to an auto show in the Chinese capital that starts Thursday, the phone is jointly developed by Polestar Automotive Holding UK Plc’s design team in Gothenburg and Chinese smartphone maker Xingji Meizu Group. Both companies are controlled by billionaire Li Shufu’s car conglomerate Zhejiang Geely Holding Group Co. Ltd. Starting from 7,388 yuan ($1,019), the phone comes with as much as 1 terabyte of storage and a 50-megapixel camera.

Surging solar demand buoyed silver last year

Demand for silver from the solar panel sector jumped 64% last year, rising more sharply than previously estimated, according to the latest industry data, with the dynamic expected to help underpin prices for the precious metal. Overall global demand for silver shrank 7% last year to 1.19 billion troy ounces, according to the Silver Institute, the first contraction since the onset of the Covid-19 pandemic in 2020. Demand for silver as jewelry fell 13%, and by 28% as a physical investment. However, demand for silver as a material for making solar panels has boomed. Silver paste is a key component in photovoltaic cells. Such demand rose 64% last year to a record 193.5 million troy ounces, roughly 20% above the initial estimate.