In Depth: Arresting Four-Year Slide of Hong Kong Stocks Hinges on Policy Support

The Hang Seng Index could rebound this year, but the extent will partly depend on whether measures by policymakers to reverse the slide can restore investor confidence, say economists and analysts

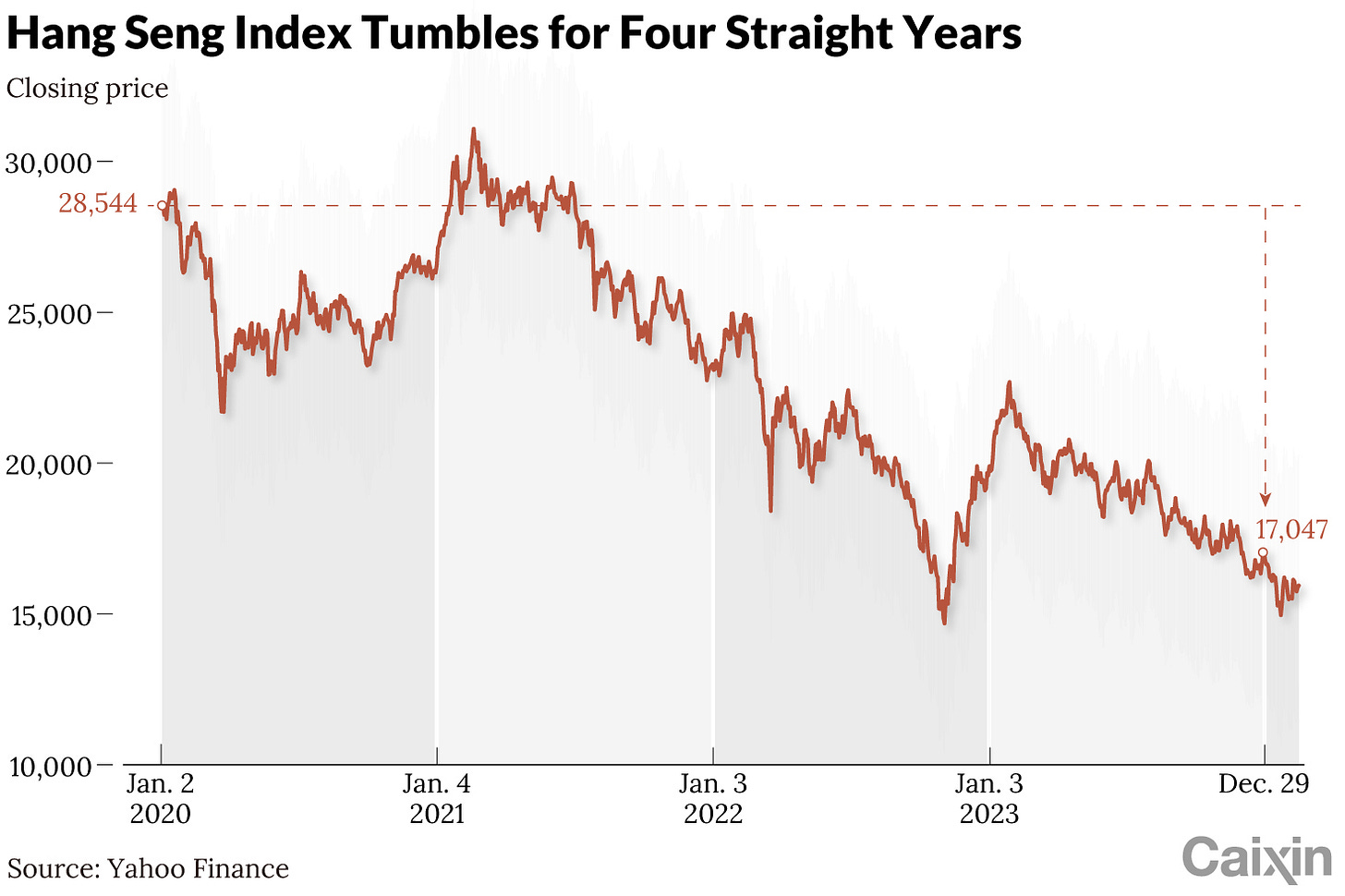

For the first time since its launch more than half a century ago, Hong Kong’s benchmark stock gauge, the Hang Seng Index (HSI), has fallen for four years in a row.

The index dropped 13.8% in 2023 and the slide carried on into the new year, falling to a 15-month low of 14,961 on Jan. 22 before picking up in February.

The Chinese mainland market has also suffered a three-year losing streak amid concerns over the economic slowdown, the ongoing property crisis and prospects for corporate earnings. The benchmark CSI 300 Index, which tracks the top 300 companies traded on the Shanghai and Shenzhen stock exchanges, dropped 11.4% last year and fell 6.3% in January this year.

The HSI is made up of 82 of the largest companies listed on the Hong Kong Stock Exchange, many of which make most of their revenue and profits from the mainland, including Tencent Holdings Ltd., and state-owned giants PetroChina Co. Ltd. and China Mobile Ltd. Mainland-linked companies account for more than three quarters of the market capitalization of the entire Hong Kong exchange.

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.