In Depth: Can CATL Stay Ahead?

Price wars, trade roadblocks and threats from emerging tech are among the headwinds facing the world’s largest EV-battery maker

CATL, the world’s largest electric-vehicle (EV) battery maker, is seeking new drivers of growth to help maintain a lead over its rivals and head off a challenge from automakers cutting into its lane.

Potential obstacles include a lack of product differentiation, price wars, and the threat of emerging technologies like solid-state batteries, which if eventually commercialized are expected to charge faster and last longer than those with conventional liquid electrolytes. Then there are the trade roadblocks, like stepped up European and U.S. import tariffs and even possible sanctions over forced labor and military concerns.

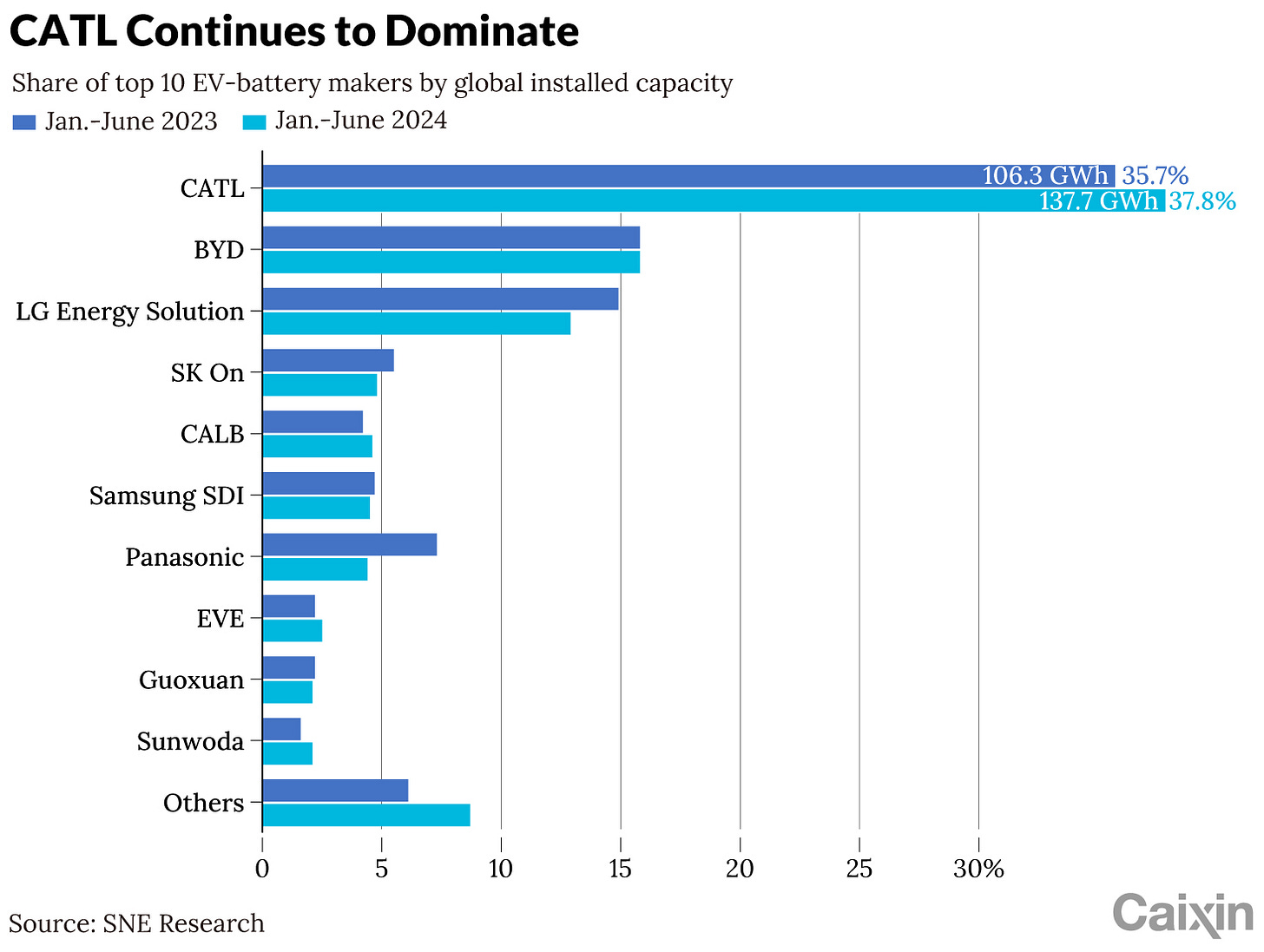

On paper, things look good. In the first six months, Contemporary Amperex Technology Co. Ltd. (CATL) (300750.SZ -0.13%) increased its global battery market share by 2.1 percentage points to 37.8%, according to latest data from SNE Research. The firm’s share of installed batteries in the domestic market grew nearly 3 percentage points in the first half, reaching 46.4%, according to data from the China Automotive Battery Innovation Alliance (CABIA).

But the emergence of second- and third-tier alternatives is starting to drag on CATL’s capacity utilization rate.

【Subscribe to know more!】

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.