In Depth: Impatient State Investors Hamstring Drive for ‘Patient Capital’ to Lead Growth

Investment in emerging sectors is at odds with officials’ annual assessment cycle and low risk tolerance

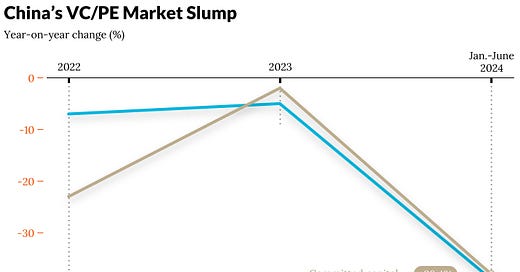

While China is calling on “patient” capital to drive growth in favored industries, the state investors who should have been a cornerstone of this effort are demanding quick returns on their venture capital (VC) and private equity (PE) investment, according to industry insiders.

Patient capital refers to long-term investments in which investors are willing to forgo immediate returns. The term has become a buzzword in China after April’s Politburo meeting called for “strengthening” the role of patient capital in developing “new quality productive forces” — a term coined by President Xi Jinping that refers to advanced, innovation-driven productivity.

The State Council, China’s cabinet, said at a Sept. 18 meeting hosted by Premier Li Qiang that the country will push state-owned capital to become more “responsible” long-term, patient capital. Policymakers hope that patient capital will support the development of companies in emerging, high-tech industries such as artificial intelligence and novel materials.

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.