In Depth: Nio Looks to Ride Uptick in EV Sales Out of Slump in Crowded Market

After months of slack growth, the firm saw a surge in July orders, a trend it’s hoping to maintain with measures such as higher sales commissions and adjusting production

From startup to prominent brand, Chinese electric-vehicle (EV) maker Nio Inc. entered the industry when it was still budding and rode the wave of demand to the top, where it is now facing competition from an influx of new and traditional carmakers.

To combat challengers eating away at its market share, the automaker has shifted strategies to prioritize sales and boost production.

From the second half of 2022, Nio’s monthly delivery volume stagnated at around 10,000 units, prompting the company’s founder William Li to say in April that if monthly sales remained the same level, he and Qin Lihong, Nio’s co-founder and president, “would have to start looking for jobs elsewhere.”

The figures worsened for April and May, with factors such as product upgrades causing monthly deliveries to plummet to just over 6,000 units. This weighed on market sentiment: When Nio announced its May sales figures on June 1, its share price dropped to $7 for the first time since June 2020.

But the company adapted and in July hit a significant milestone by delivering over 20,000 units for the first time.

Intensified competition

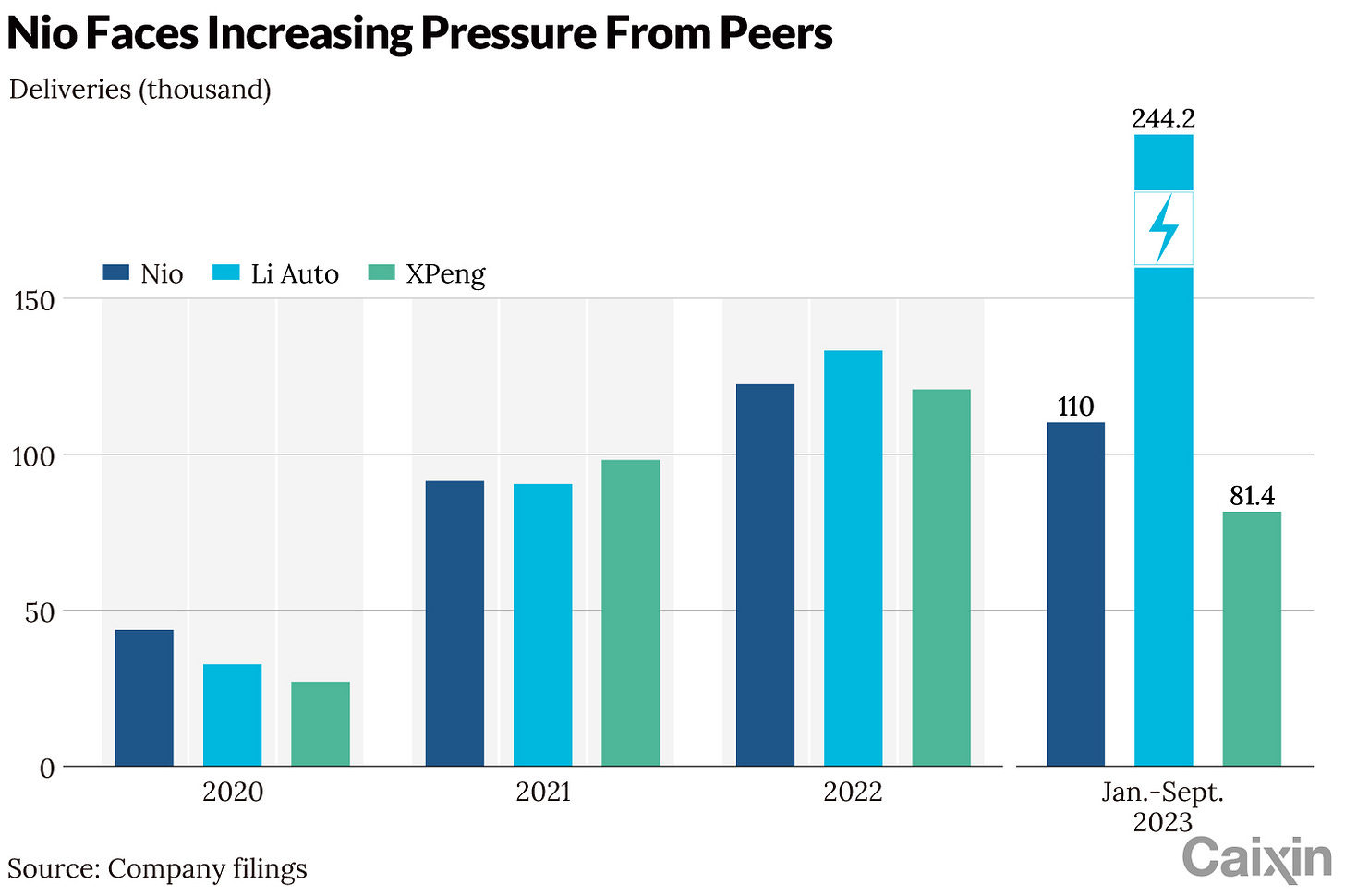

From 2020 through 2022, China’s leading new-energy vehicle (NEV) startups Nio, XPeng Inc., and Li Auto Inc. competed closely with each other, with their sales volumes showing little disparity. The trio respectively claimed the top positions in annual deliveries.

However, in 2023, Li Auto, which makes hybrid EVs, shot ahead with cumulative sales of more than 244,000 cars in the first nine months, compared with Nio’s 110,000 and XPeng’s 81,000, according to company filings.

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.