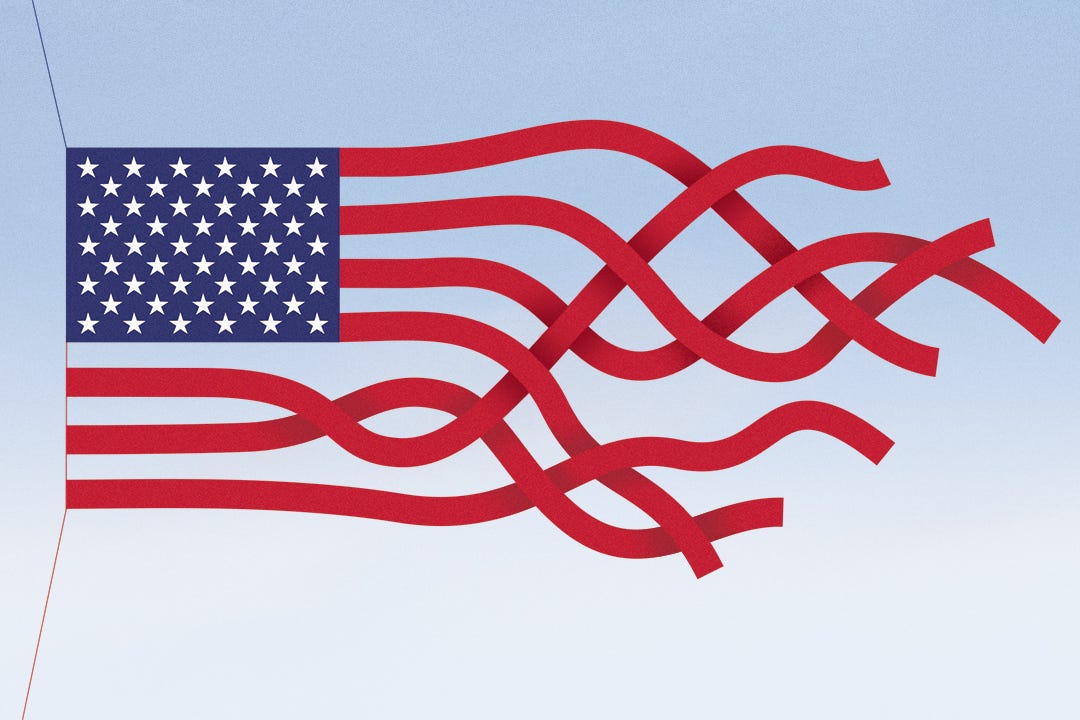

Two months into Donald Trump’s presidency, the promised economic lift from his policies has yet to take hold. Instead, U.S. stocks have tumbled amid mounting concerns over the administration’s unpredictable agenda and fears of a slowdown in the world’s largest economy.

Since Inauguration Day, the S&P 500 has dropped 10.5% from its peak, while the tech-heavy Nasdaq Composite has fallen 14.3%. Though markets steadied somewhat by late March, lingering policy uncertainty continues to drag on both the economy and investor sentiment.

Working-class Americans, in particular, are growing anxious. Tariffs are pushing prices higher, and many worry wages won’t keep pace. This pessimism is showing up in consumer confidence data. The University of Michigan’s index fell to 57.9 in March, down 11% from February and 27% year-on-year. Meanwhile, the U.S. Chamber of Commerce’s consumer expectations index hit a 12-year low of 65.1 — a reading below 80 often signals a risk of recession.

【Subscribe now and check out more coverage about Trump tariff. Less than $0.7/week!】

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.