Long Read: Remembering Luminary Economist Stanley Fischer

The MIT professor helped shape the foundations of New Keynesian economics and influenced generations of economists and policymakers

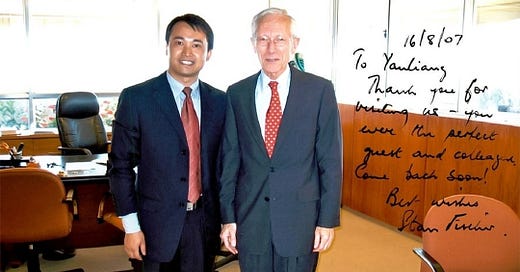

On May 31, a towering figure in macroeconomics, Stanley Fischer, died at his home in Massachusetts in the U.S. at the age of 81. A few colleagues who knew I had studied under Fischer passed on the news. It was difficult for me to process the grief, as memories of nearly two decades of learning from him, knowing him, and interacting with him came flooding back.

I wondered how Fischer would summarize his legendary life. Perhaps, in his mind, the most meaningful aspect was his spirit of engaging with the world and serving it by integrating Keynesian theory with practice.

Fischer was a great synthesizer of Keynesianism, a major founder of New Keynesian economics, and the economist most like Keynes.

Academically, he helped formalize wage rigidity — a situation where wages do not easily go up or down when economic conditions change — bridging the Chicago School’s theory of rational expectations with the Keynesian belief in the effectiveness of monetary policy.

Editor’s note: The Chicago School’s theory of rational expectations holds that people forecast future variables — like inflation or interest rates — using all available information and economic reasoning, not just past trends. This challenges older Keynesian views, which assumed people had adaptive expectations and could be surprised by policy changes.

While Keynesians argue that monetary policy can stimulate the economy in the short term, rational expectations theory suggests such effects may be limited, as people adjust their behavior in anticipation, offsetting the policy’s intended impact.

On the policy front,

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.