Making Sense of China’s Controversial Trade Surplus Data

As the gap grows between the figures calculated by the customs administration and the forex regulator, senior state researcher Zhang Ming offers up some explanations for the disparity

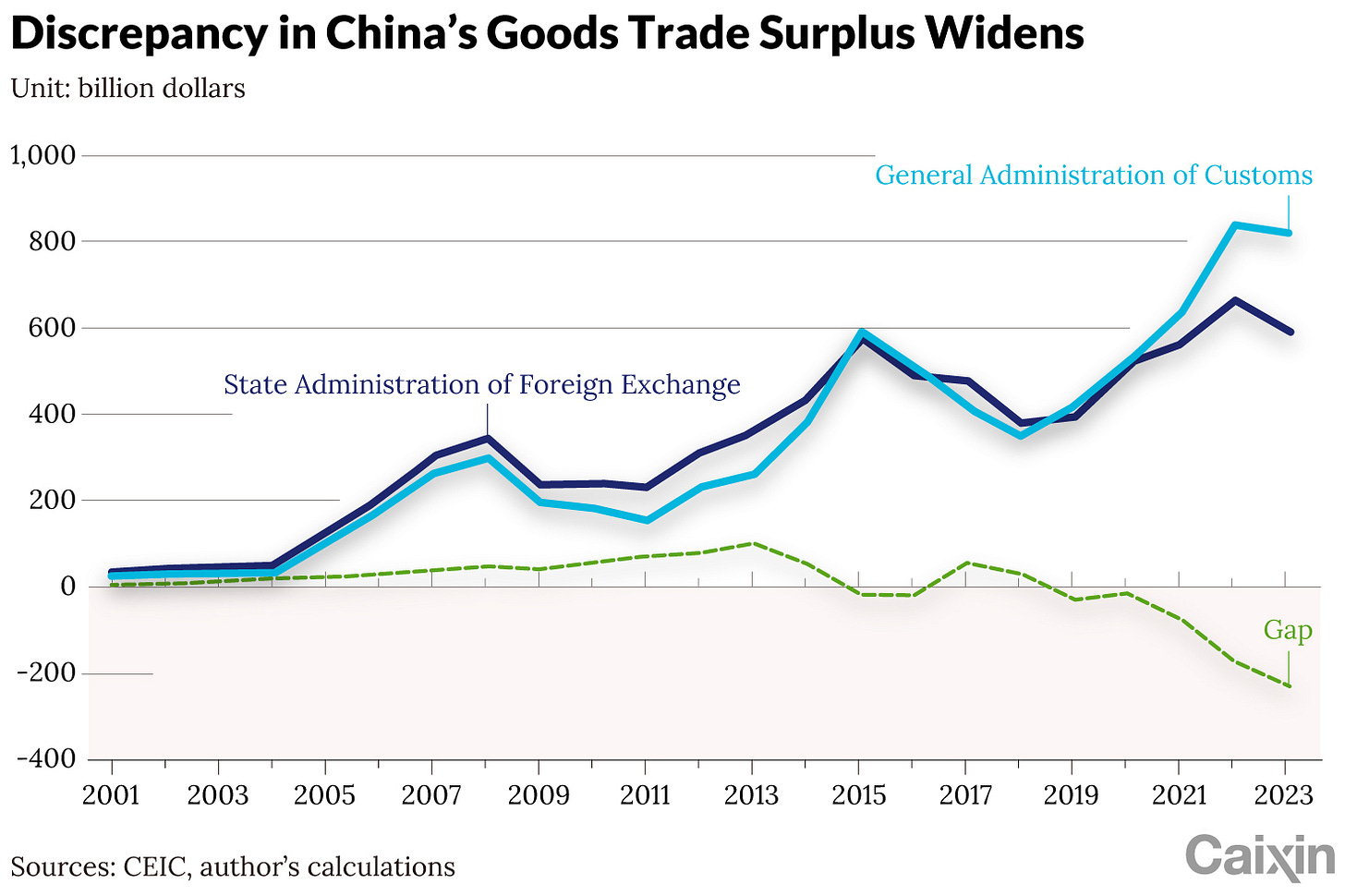

In the past two years, the difference between China’s goods trade surplus based on customs data and balance of payments (BOP) data has widened significantly. From 2019 to 2023, the BOP-based goods trade surplus, published by the State Administration of Foreign Exchange (SAFE), was lower than the surplus reported by the General Administration of Customs by $28.1 billion, $12.9 billion, $73.9 billion, $172.9 billion, and $228.2 billion, respectively. The discrepancy in 2023 was equivalent to 38.4% of the BOP-based goods trade surplus and attracted wide international attention.

Some Western media interpreted the gap as the Chinese government deliberately underreporting both its goods trade surplus and its current account surplus. They suggested that China’s trade imbalances and overcapacity issues are far more severe than suggested by the BOP-based data. But is this really the case?

【Get the exclusive offer and stay informed】

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.