Most of China’s Top Auto Suppliers Are Expanding Into Europe, Report Shows

North America and Southeast Asia are also favored destinations as firms look to avoid tariffs and better serve carmakers with local operations

Chinese suppliers of both auto hardware and software are following their carmaking clients overseas, particularly focusing on Europe and North America, a new report showed.

The suppliers have several motivations, such as being more responsive to their Chinese clients with assembly plants abroad, reducing shipping costs, avoiding tariffs and localizing their operations, according to industry data compiled by Cyzone research center and a subsidiary of China Automotive Technology and Research Center Co. Ltd.

Related:

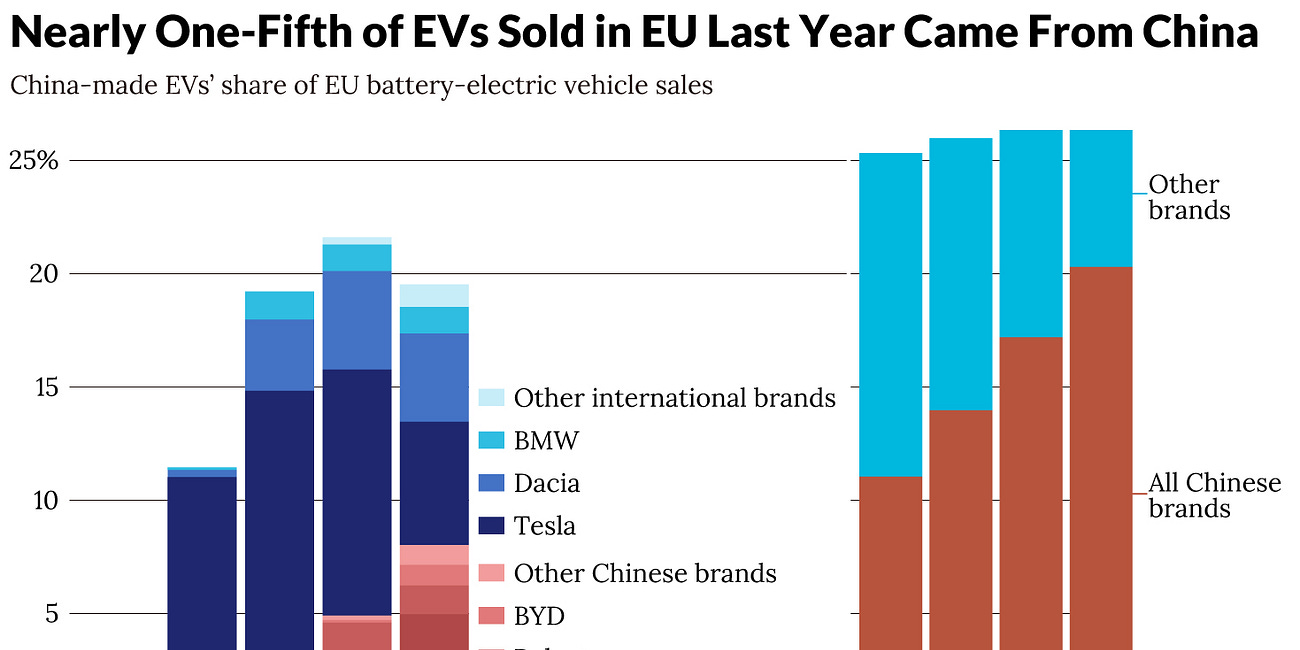

Caixin Explains: How the EU’s New Tariff Hikes Will Affect China-Made EVs

The European Union has decided to provisionally impose extra tariffs of up to 38.1% on battery-electric vehicles shipped from China as part of an ongoing investigation finding that state subsidies are enabling Chinese electric-car makers to undercut their EU rivals, despite divisions in Europe over the issue.

Keep reading with a 7-day free trial

Subscribe to Caixin Global China Watch to keep reading this post and get 7 days of free access to the full post archives.