Tech Insider: China’s Soaring Solar Giants, Huawei Scores Big With New Phone

Tesla’s China deliveries rebound, EV war gets uglier

A worker processes solar photovoltaic modules for export on Aug. 28 in Lianyungang, East China’s Jiangsu province. Photo: VCG

Are Chinese solar giants flying too close to the sun?

China’s solar-panel makers, who already account for up to 95% of global manufacturing capacity, are doubling down on their investment in the booming segment, announcing expansion plans up and down the supply chain.

But with capacity already exceeding demand and on track to balloon by 2030 to far in excess of forecast market requirements, analysts and investors alike are beginning to question whether these plans are justified.

Planned capacity of the top five Chinese manufacturers will increase by 54% by the end of this year from 2022 to reach 465 gigawatts (GW), according to Caixin’s calculations based on companies’ financial reports.

Indeed, their combined shipment target of 310 GW to 325 GW this year can already meet most of the world’s total demand, according to Caixin’s calculations based on the companies’ financial reports.

New Huawei handset sells fast as chip speculation swirls

Chinese consumers have been buying Huawei’s latest flagship smartphone faster than stores can keep up with online and in some parts of the country, sources tell Caixin, amid mounting speculation the telecom giant has been able to weather U.S. sanctions.

Huawei Technologies Co. Ltd. began shipping the new Mate 60 Pro Sunday, several people familiar with the matter told Caixin, five days after the phone’s discreet launch. A number of distributors told Caixin on Monday that the Mate 60 Pro had immediately sold out upon delivery.

“The stock we got on Sunday was gone immediately. It was only enough to fulfill around 20% of preorders,” one distributor in Chongqing told Caixin.

A number of Huawei’s authorized outlets were unable to even get their hands on a display model of the Mate 60 Pro, one employee at such a store said. They said the store received fewer than 20 of the new smartphones on Sunday, and there are still dozens of customers waiting for their new phones to arrive.

Huawei put the Mate 60 Pro up for sale at 6,999 yuan ($962) on Aug. 29, selling out on its official site that same night.

Tesla’s China deliveries rebound as it cuts price

Tesla Inc.’s China deliveries surged last month as the electric-vehicle (EV) maker cut prices and rolled out the long-anticipated revamped Model 3.

The automaker delivered 84,159 vehicles from its Shanghai plant in August, according to preliminary industry group data. The numbers represent a 31% jump from July and a 9.3% increase from a year earlier.

Tesla ignited another round of the price war in August, cutting the cost of some versions of the Model Y by about 4% in mid-August. While Tesla CEO Elon Musk previously said global production would drop in the third quarter due to downtime for factory upgrades, momentum in the Shanghai plant seems to have picked up again. August was the third-highest month for deliveries so far this year.

China’s EV war just got even uglier

The EV price war in China is heating up as top players like Tesla launch new models and others slashed prices to counter slowing growth in the world’s biggest auto market.

Tesla became the latest to kick things off Friday when it unveiled its revamped Model 3. Minutes later, the company slashed prices across its range of Model S and X cars in China and the U.S.

Guangzhou-based XPeng Inc. was quick to follow. Seen as one of the most direct competitors to Tesla, it said it will now offer discounts on its flagship P7i sedan for the month of September.

Other automakers also piled in with Zhejiang Leapmotor Technologies Ltd. discounting the price of its T03 compact hatchback, according to a social media post.

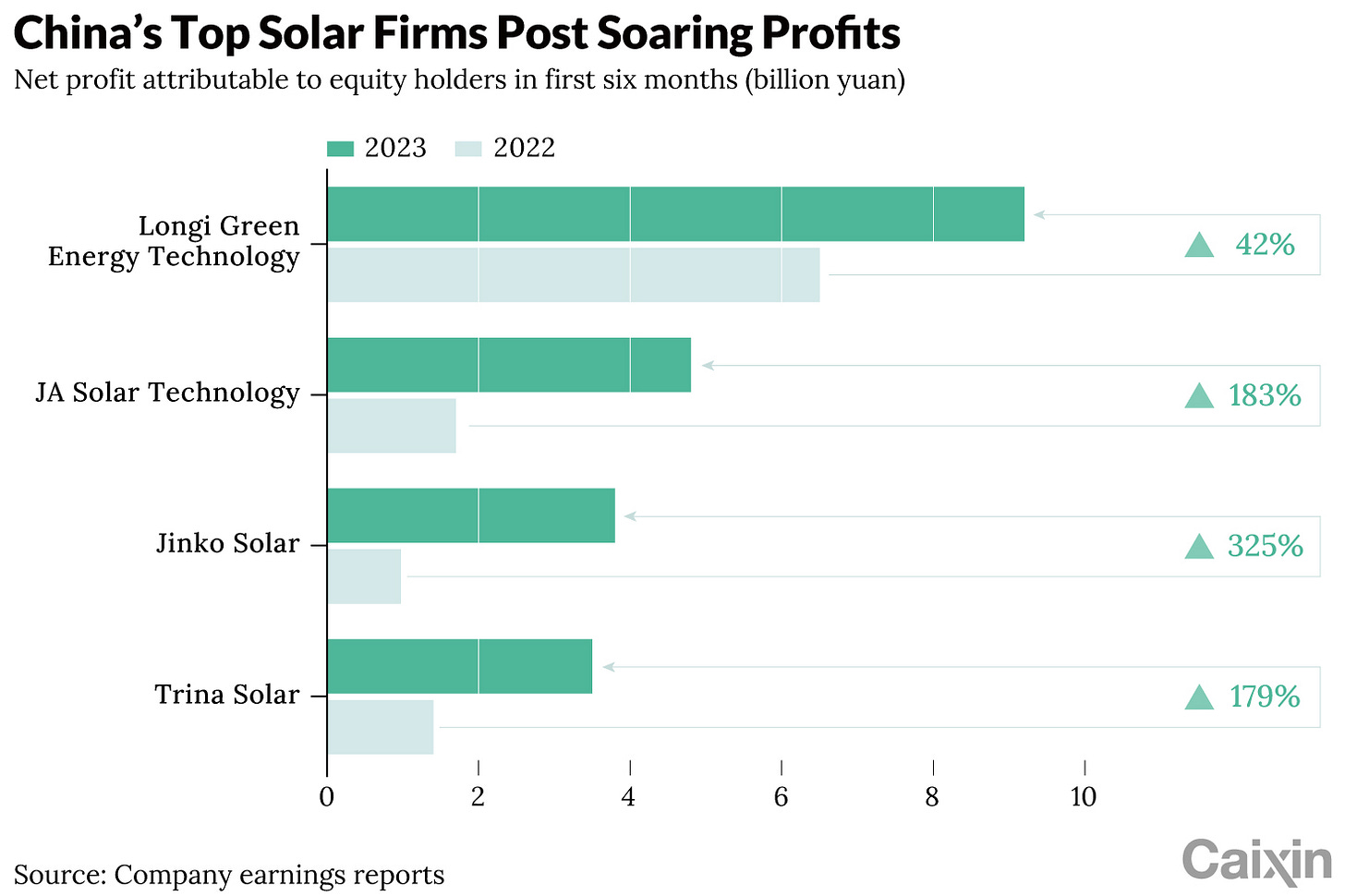

Charts: China’s solar profits surge as oversupply looms

China’s biggest photovoltaic manufacturers reported surging profits in the first half of 2023 driven by strong demand, but warned about imminent overcapacity as a result of ramped up production.

Falling raw material prices accelerated demand amid the transition to clean energy, bolstering domestic solar installations by 78.4 GW in the first half, a 154% year-on-year increase and nearing last year’s 87.4 GW, according to the National Energy Administration.

The industry leaders are rapidly expanding production capacity. By the end of this year, JA Solar Technology Co. Ltd. will have nearly doubled its panel-making capacity to 95 GW, while Longi Green Energy Technology Co. Ltd. will target capacity of 130 GW, according to the companies’ financial filings.