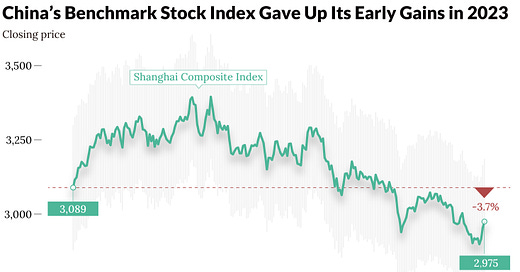

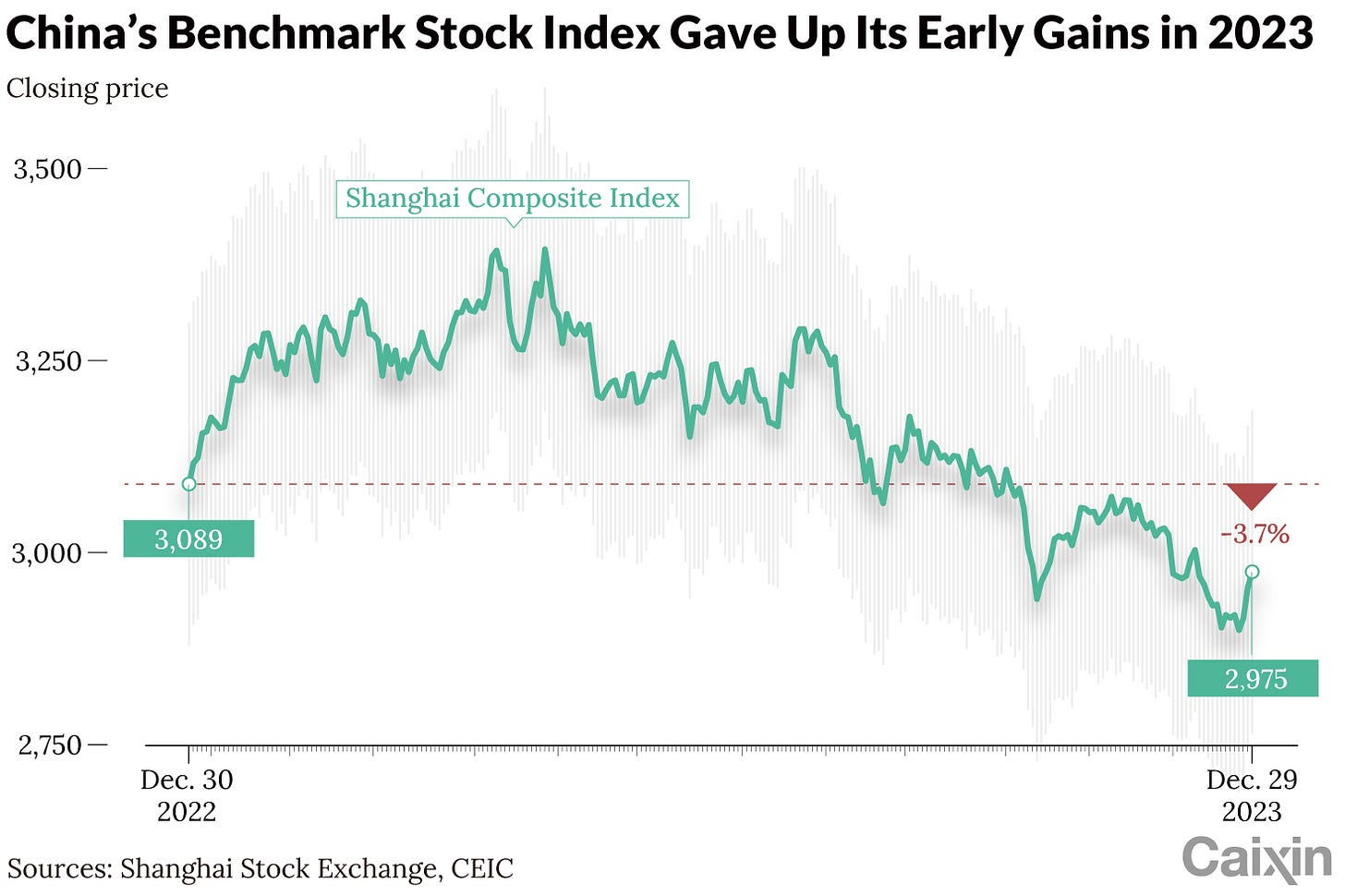

Year in Review: China’s Fight to Regain Its Early Stock Market Mojo

A surge in share prices at the beginning of 2023 didn’t last as investors quickly lost confidence in an economic recovery that failed to live up to expectations

China’s stock market got off to a monumental start in 2023, when overseas investors in January poured more money into Chinese mainland shares on the net than they ever had in a single month through its trading links with Hong Kong. However, it didn’t last.

Investor confidence faltered in February after an anticipated surge in economic activity during the weeklong Lunar New Year holiday failed to live up to expectations. The Chinese balloon incident and the expansion of a U.S. trade blacklist further undermined market sentiment.

It was a year of volatile swings for the Chinese stock market, with the closing price of the benchmark Shanghai Composite Index climbing as high as 3,395 on May 8. Since then, however, the index has been on a clear downward slope. It fell 3.7% for the whole year.

The early rise and subsequent fall of Chinese stock prices reflected the uncertainty that pervaded the world’s second-largest economy in 2023, with the ongoing property slump serving as an important drag.

At a meeting of the Politburo in July, policymakers vowed to double down on support for the housing market, calling for policies to be adjusted to “facilitate the steady and sound development of the real estate market.”

The meeting led to a modest rebound in the Shanghai Composite Index. Many local governments followed up with their own plans to ease homebuying restrictions that had been designed to cool the formerly hot property market. The goal was to revive housing demand and give the economy a boost. However, households remained reluctant to buy, so the measures failed to give the economy much of a jolt. One could see this reflected in the stock market as the Shanghai Composite Index quickly gave back its late July gains the following month.

In September, a short-lived uptick in new-home sales failed to boost investor confidence. Drops in new-home sales in the following two months undermined confidence further.

After July’s Politburo meeting, regulators took a series of steps to help invigorate the stock market, such as lowering the stamp duty on stock trades, tightening IPO regulations to limit the number of offerings, and reducing the minimum margin ratio for stock purchases through margin financing. In December, China’s securities watchdog released new regulations for listed companies that focused on share buybacks and cash dividends, aiming to boost market confidence. However, these measures fell short of reigniting investor optimism.

Domestic stocks were also buffeted by forces from outside the country. The Federal Reserve’s series of rate hikes in 2023 drew capital from emerging markets to the U.S., putting pressure on mainland share prices.

In the third quarter, a gauge of foreign direct investment in China turned negative for the first time on record, according to the forex watchdog’s preliminary data.

Policymakers have been stepping up efforts to further open up markets to attract overseas capital, including a 24-point guideline in August designed to encourage eligible foreign investors to establish investment vehicles and regional headquarters in the country. In September, the People’s Bank of China and the State Administration of Foreign Exchange held discussions with foreign businesses in a bid to give more financial support to overseas investors.

In October, President Xi Jinping vowed to remove all restrictions on foreign investment in the manufacturing sector. The following month, the commerce ministry announced that it would look into removing more sectors from the negative list that restricts market access for overseas investors.

However, these moves are unlikely to result in a quick turnaround of the prevailing conditions in China’s stock market. The rejuvenation of the domestic capital market will depend on addressing the core issues that influence investor confidence, such as fostering corporate innovation and increasing the wealth of the country’s citizens.